14.93 With 6 Sales Tax

The Internal Revenue Service (IRS) has released data on private income taxes for tax yr 2019, showing the number of taxpayers, adjusted gross income, income taxation paid, and income tax shares by income percentiles.[1] The new data outlines the taxation organization under the second year of the Tax Cuts and Jobs Act (TCJA), the last year before the onset of the COVID-nineteen pandemic.

The information demonstrates the U.S. private income tax continues to be progressive, borne primarily by the highest income earners.

Key Findings

- In 2019, taxpayers filed 148.3 one thousand thousand tax returns, reported earning well-nigh $11.9 trillion in adjusted gross income, and paid $1.half-dozen trillion in individual income taxes.

- The top one percentage of taxpayers paid a 25.6 percentage average private income revenue enhancement rate, which is more 7 times higher than taxpayers in the bottom 50 percent (3.5 percent).

- The share of reported income earned by the meridian 1 percent of taxpayers roughshod to xx.i percentage from 20.nine percent in 2018. The acme 1 per centum's share of federal private income taxes paid savage to 38.eight percent from 40.1 per centum.

- The top l percent of all taxpayers paid 97 percent of all individual income taxes, while the lesser 50 pct paid the remaining 3 per centum.

- The top 1 pct paid a greater share of private income taxes (38.viii percent) than the bottom 90 percent combined (29.2 pct).

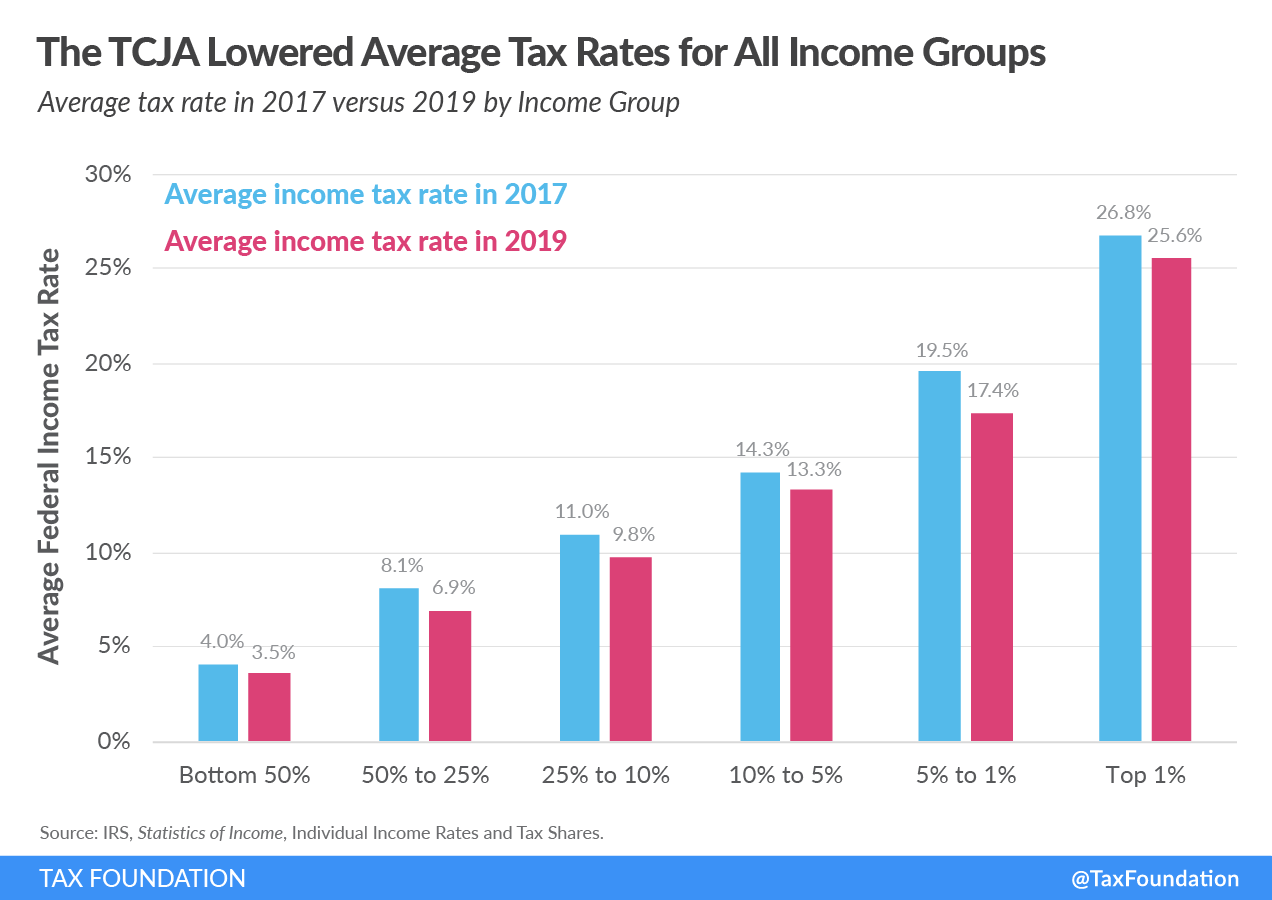

- The Tax Cuts and Jobs Act reduced average tax rates across income groups.

Reported Income and Taxes Paid Increased in Tax Year 2019

Taxpayers reported nearly $11.ix trillion in adapted gross income (AGI) on 148.3 one thousand thousand taxation returns in 2019. The number of returns filed rose past 3.9 million (2.7 percent) and reported AGI rose past $319 million (2.8 pct) in a higher place 2018 levels. Total income taxes paid rose by $42 billion to $1.58 trillion, a 2.7 percent increase above 2018. The average private income revenue enhancement rate was nearly unchanged: 13.29 percent in 2019, compared to 13.28 percent in 2018.

| Top 1% | Peak five% | Top ten% | Top 25% | Top fifty% | Bottom fifty% | All Taxpayers | |

|---|---|---|---|---|---|---|---|

| Number of Returns | 1,482,459 | 7,412,296 | 14,824,593 | 37,061,482 | 74,122,965 | 74,122,965 | 148,245,929 |

| Adjusted Gross Income ($ millions) | $2,393,383 | $iv,269,727 | $5,621,027 | $8,177,266 | $10,517,131 | $one,365,719 | $11,882,850 |

| Share of Full Adjusted Gross Income | 20.1% | 35.nine% | 47.3% | 68.8% | 88.5% | 11.5% | 100.0% |

| Income Taxes Paid ($ millions) | $612,027 | $938,429 | $ane,117,856 | $1,367,843 | $1,530,288 | $48,373 | $1,578,661 |

| Share of Total Income Taxes Paid | 38.eight% | 59.4% | 70.8% | 86.6% | 96.9% | 3.i% | 100.0% |

| Income Split Betoken | $546,434 | $221,572 | $154,589 | $87,917 | $44,269 | $44,269 | |

| Average Tax Charge per unit | 25.6% | 22.0% | nineteen.nine% | 16.seven% | 14.6% | 3.5% | 13.3% |

| Average Income Taxes Paid | $412,846 | $126,604 | $75,406 | $36,907 | $twenty,645 | $653 | $x,649 |

| Annotation: Table does not include dependent filers. "Income split point" is the minimum AGI for tax returns to fall into each percentile. "Income taxes paid" is the sum of income revenue enhancement after credits (including the subtraction of excess advance premium tax credit repayment, the earned income credit, American opportunity credit, health coverage taxation credit, and the regulated investment credit credit) limited to aught plus cyberspace investment income tax from Form 8960 and the taxation from Grade 4970, Tax on Accumulation Distribution of Trusts. It does not include whatever refundable portions of these credits. Source: IRS,Statistics of Income, "Individual Income Rates and Tax Shares." | |||||||

High-Income Taxpayers Paid the Highest Boilerplate Income Tax Rates

In 2019, taxpayers with college incomes paid much higher boilerplate income tax rates than lower-income taxpayers.[2]

The bottom fifty percentage of taxpayers (taxpayers with AGI below $44,269) faced an boilerplate income taxation rate of 3.5 percent. As household income increases, boilerplate income tax rates rise. For example, taxpayers with AGI betwixt the top 10th and fifth percentiles ($154,589 and $221,572) paid an average income revenue enhancement rate of 13.3 per centum—3.eight times the rate paid by taxpayers in the bottom fifty percent.

The top 1 percent of taxpayers (AGI of $546,434 and above) paid the highest effective income revenue enhancement rate of 25.6 percent—more than seven times the rate faced past the bottom fifty per centum of taxpayers.

Readers should note the IRS dataset excludes the refundable portion of taxation credits such as the earned income tax credit, which means the IRS data overstates the tax rate paid by taxpayers at the bottom.

High-Income Taxpayers Paid the Majority of Federal Income Taxes

In 2019, the bottom 50 per centum of taxpayers (taxpayers with AGI below $44,269) earned eleven.5 percent of total AGI and paid 3.ane percent ($48.iv billion) of all federal individual income taxes.

The elevation i percent (taxpayers with AGI of $546,434 and to a higher place) earned xx.one percentage of full AGI in 2019 and paid 38.8 pct of all federal income taxes.

In 2019, the acme 1 percent of taxpayers deemed for more income taxes paid than the bottom xc per centum combined. The top 1 percentage of taxpayers paid $612 billion in income taxes while the bottom 90 per centum paid $461 billion in income taxes.

Readers should note the IRS dataset does not business relationship for the refundable portion of taxation credits such every bit the earned income taxation credit. If the refundable portion were included, the taxation share of the pinnacle income groups would be higher than what is reported here. The refundable portion is classified as a spending program by the Part of Management and Budget (OMB) and therefore is non included by the IRS in tax share figures.

The share of income taxes paid by the meridian one percentage increased from 33.2 percent in 2001 to 38.8 percent in 2019, down about 1.three percentage points from a high of 40.i pct in 2018. Over the same menstruation, the share paid by the lesser 50 percent of taxpayers fell from 4.ix percent to just over iii percent in 2019, upwards almost a tenth of a percentage point from 2018.

Similarly, the share of adapted gross income reported past the top 1 percent increased from 17.4 percentage in 2001 to xx.one percent in 2019. The AGI share of the top ane percent fluctuates considerably over the business bicycle, ascent with expansions and falling with contractions to a greater extent than income reported by other groups. The share of AGI reported past the bottom 50 percent of taxpayers fell from xiv.4 pct in 2001 to 11.5 percent in 2019.

The Tax Cuts and Jobs Human action Reduced Average Tax Rates Beyond Income Groups

The 2019 filing season was the second filing flavor nether the TCJA. The TCJA made many pregnant, but temporary, changes to the individual income tax code including lower revenue enhancement rates, wider brackets, a larger standard deduction, and an expanded child taxation credit. The net effect of all the changes was to lower tax burdens, on boilerplate, for taxpayers across all income levels.

In 2019, individual taxpayers paid $ane.vi trillion in private income taxes, $23 billion less than in 2017, even as adjusted gross income was $946 billion higher. Average taxation rates were lower in 2019 than in 2017 across all income groups. Average rates for the lesser 50 percent brutal from four.05 per centum in 2017 to 3.54 per centum in 2019 and for the top 1 per centum, from 26.76 per centum to 25.57 percent.

The share of income taxes paid by the bottom 50 pct of taxpayers changed little from 2017, when it was 3.11 percent, to 3.06 percent in 2019. The share of income taxes paid past the top 1 percent increased slightly from 38.47 percent in 2017 to 38.77 percent in 2019.

Appendix

- For data prior to 2001, all tax returns that have a positive AGI are included, fifty-fifty those that do not have a positive income revenue enhancement liability. For data from 2001 forward, returns with negative AGI are too included, but dependent returns are excluded.

- Income revenue enhancement subsequently credits (the measure of "income taxes paid" higher up) does not business relationship for the refundable portion of tax credits such as the earned income taxation credit. If the refundable portion were included, the tax share of the top income groups would exist college and the boilerplate tax charge per unit of bottom income groups would be lower. The refundable portion is classified as a spending programme by the OMB and therefore is not included by the IRS in these figures.

- The just tax analyzed here is the federal individual income tax, which is responsible for more than 25 percentage of the nation'southward taxes paid (at all levels of government). Federal income taxes are much more progressive than federal payroll taxes, which are responsible for about 20 percent of all taxes paid (at all levels of government) and are more progressive than most state and local taxes.

- AGI is a fairly narrow income concept and does not include income items similar government transfers (except for the portion of Social Security benefits that is taxed), the value of employer-provided health insurance, underreported or unreported income (most notably that of sole proprietors), income derived from municipal bond interest, and net imputed rental income.

- The unit of assay here is the tax return. In the figures prior to 2001, some dependent returns are included. Nether other units of analysis (like the U.S. Treasury Department's Family Economic Unit), these returns would likely be paired with parents' returns.

- These figures represent the legal incidence of the income tax. Near distributional tables (such equally those from the Congressional Budget Office, the Tax Policy Center, Citizens for Tax Justice, the Treasury Section, and the Articulation Committee on Taxation) assume that the entire economical incidence of personal income taxes falls on the income earner.

| Year | Total | Elevation 0.1% | Top ane% | Tiptop v% | Between 5% and x% | Top 10% | Between 10% and 25% | Acme 25% | Between 25% and 50% | Summit 50% | Bottom l% |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1981 | 94,587 | 946 | 4,729 | 4,729 | 9,459 | 14,188 | 23,647 | 23,647 | 47,293 | 47,293 | |

| 1982 | 94,426 | 944 | iv,721 | 4,721 | 9,443 | 14,164 | 23,607 | 23,607 | 47,213 | 47,213 | |

| 1983 | 95,331 | 953 | 4,767 | 4,767 | ix,533 | 14,300 | 23,833 | 23,833 | 47,665 | 47,665 | |

| 1984 | 98,436 | 984 | 4,922 | 4,922 | ix,844 | xiv,765 | 24,609 | 24,609 | 49,218 | 49,219 | |

| 1985 | 100,625 | 1,006 | 5,031 | 5,031 | x,063 | xv,094 | 25,156 | 25,156 | 50,313 | 50,313 | |

| 1986 | 102,088 | ane,021 | 5,104 | 5,104 | 10,209 | 15,313 | 25,522 | 25,522 | 51,044 | 51,044 | |

| The Tax Reform Act of 1986 changed the definition of AGI, and then data higher up and beneath this line is not strictly comparable. | |||||||||||

| 1987 | 106,155 | one,062 | 5,308 | five,308 | x,615 | 15,923 | 26,539 | 26,539 | 53,077 | 53,077 | |

| 1988 | 108,873 | i,089 | 5,444 | v,444 | ten,887 | sixteen,331 | 27,218 | 27,218 | 54,436 | 54,436 | |

| 1989 | 111,313 | i,113 | 5,566 | 5,566 | 11,131 | xvi,697 | 27,828 | 27,828 | 55,656 | 55,656 | |

| 1990 | 112,812 | ane,128 | v,641 | 5,641 | 11,281 | 16,922 | 28,203 | 28,203 | 56,406 | 56,406 | |

| 1991 | 113,804 | i,138 | 5,690 | 5,690 | 11,380 | 17,071 | 28,451 | 28,451 | 56,902 | 56,902 | |

| 1992 | 112,653 | 1,127 | 5,633 | 5,633 | xi,265 | 16,898 | 28,163 | 28,163 | 56,326 | 56,326 | |

| 1993 | 113,681 | 1,137 | five,684 | v,684 | 11,368 | 17,052 | 28,420 | 28,420 | 56,841 | 56,841 | |

| 1994 | 114,990 | one,150 | v,749 | 5,749 | 11,499 | 17,248 | 28,747 | 28,747 | 57,495 | 57,495 | |

| 1995 | 117,274 | 1,173 | 5,864 | v,864 | 11,727 | 17,591 | 29,319 | 29,319 | 58,637 | 58,637 | |

| 1996 | 119,442 | one,194 | 5,972 | 5,972 | 11,944 | 17,916 | 29,860 | 29,860 | 59,721 | 59,721 | |

| 1997 | 121,503 | 1,215 | 6,075 | 6,075 | 12,150 | 18,225 | 30,376 | 30,376 | sixty,752 | 60,752 | |

| 1998 | 123,776 | one,238 | 6,189 | 6,189 | 12,378 | 18,566 | 30,944 | thirty,944 | 61,888 | 61,888 | |

| 1999 | 126,009 | 1,260 | 6,300 | 6,300 | 12,601 | 18,901 | 31,502 | 31,502 | 63,004 | 63,004 | |

| 2000 | 128,227 | one,282 | 6,411 | half-dozen,411 | 12,823 | nineteen,234 | 32,057 | 32,057 | 64,114 | 64,114 | |

| The IRS changed methodology, so data in a higher place and beneath this line is non strictly comparable. | |||||||||||

| 2001 | 119,371 | 119 | one,194 | 5,969 | 5,969 | 11,937 | 17,906 | 29,843 | 29,843 | 59,685 | 59,685 |

| 2002 | 119,851 | 120 | 1,199 | five,993 | 5,993 | 11,985 | 17,978 | 29,963 | 29,963 | 59,925 | 59,925 |

| 2003 | 120,759 | 121 | 1,208 | 6,038 | 6,038 | 12,076 | eighteen,114 | 30,190 | thirty,190 | 60,379 | threescore,379 |

| 2004 | 122,510 | 123 | 1,225 | 6,125 | 6,125 | 12,251 | 18,376 | thirty,627 | thirty,627 | 61,255 | 61,255 |

| 2005 | 124,673 | 125 | 1,247 | half-dozen,234 | six,234 | 12,467 | 18,701 | 31,168 | 31,168 | 62,337 | 62,337 |

| 2006 | 128,441 | 128 | one,284 | 6,422 | 6,422 | 12,844 | 19,266 | 32,110 | 32,110 | 64,221 | 64,221 |

| 2007 | 132,655 | 133 | 1,327 | 6,633 | 6,633 | 13,265 | nineteen,898 | 33,164 | 33,164 | 66,327 | 66,327 |

| 2008 | 132,892 | 133 | one,329 | half dozen,645 | vi,645 | 13,289 | xix,934 | 33,223 | 33,223 | 66,446 | 66,446 |

| 2009 | 132,620 | 133 | one,326 | half dozen,631 | 6,631 | thirteen,262 | nineteen,893 | 33,155 | 33,155 | 66,310 | 66,310 |

| 2010 | 135,033 | 135 | 1,350 | 6,752 | 6,752 | 13,503 | 20,255 | 33,758 | 33,758 | 67,517 | 67,517 |

| 2011 | 136,586 | 137 | i,366 | 6,829 | 6,829 | 13,659 | xx,488 | 34,146 | 34,146 | 68,293 | 68,293 |

| 2012 | 136,080 | 136 | 1,361 | 6,804 | six,804 | 13,608 | 20,412 | 34,020 | 34,020 | 68,040 | 68,040 |

| 2013 | 138,313 | 138 | 1,383 | half dozen,916 | 6,916 | 13,831 | twenty,747 | 34,578 | 34,578 | 69,157 | 69,157 |

| 2014 | 139,562 | 140 | 1,396 | 6,978 | half-dozen,978 | 13,956 | 20,934 | 34,891 | 34,891 | 69,781 | 69,781 |

| 2015 | 141,205 | 141 | one,412 | 7,060 | 7,060 | 14,120 | 21,181 | 35,301 | 35,301 | 70,602 | seventy,602 |

| 2016 | 140,889 | 141 | one,409 | 7,044 | vii,044 | 14,089 | 21,133 | 35,222 | 35,222 | 70,444 | 70,444 |

| 2017 | 143,295 | 143 | 1,433 | 7,165 | 7,165 | fourteen,330 | 21,494 | 35,824 | 35,824 | 71,648 | 71,648 |

| 2018 | 144,318 | 144 | one,443 | 7,216 | 7,216 | 14,432 | 21,648 | 36,079 | 36,079 | 72,159 | 72,159 |

| 2019 | 148,246 | 148 | 1,482 | 7,412 | 7,412 | 14,825 | 22,237 | 37,061 | 37,061 | 74,123 | 74,123 |

| Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares (2019). | |||||||||||

| Twelvemonth | Total | Top 0.i% | Summit 1% | Pinnacle v% | Betwixt 5% & 10% | Top x% | Betwixt ten% & 25% | Summit 25% | Betwixt 25% & 50% | Top 50% | Bottom fifty% |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1980 | $1,627 | $138 | $342 | $181 | $523 | $400 | $922 | $417 | $1,339 | $288 | |

| 1981 | $1,791 | $149 | $372 | $201 | $573 | $442 | $ane,015 | $458 | $1,473 | $318 | |

| 1982 | $1,876 | $167 | $398 | $207 | $605 | $460 | $i,065 | $478 | $1,544 | $332 | |

| 1983 | $1,970 | $183 | $428 | $217 | $646 | $481 | $1,127 | $498 | $one,625 | $344 | |

| 1984 | $ii,173 | $210 | $482 | $240 | $723 | $528 | $1,251 | $543 | $ane,794 | $379 | |

| 1985 | $2,344 | $235 | $531 | $260 | $791 | $567 | $ane,359 | $580 | $one,939 | $405 | |

| 1986 | $2,524 | $285 | $608 | $278 | $887 | $604 | $1,490 | $613 | $2,104 | $421 | |

| The Revenue enhancement Reform Human activity of 1986 changed the definition of AGI, and then information in a higher place and beneath this line is non strictly comparable. | |||||||||||

| 1987 | $2,814 | $347 | $722 | $316 | $1,038 | $671 | $1,709 | $664 | $two,374 | $440 | |

| 1988 | $iii,124 | $474 | $891 | $342 | $ane,233 | $718 | $1,951 | $707 | $ii,658 | $466 | |

| 1989 | $3,299 | $468 | $918 | $368 | $1,287 | $768 | $ii,054 | $751 | $two,805 | $494 | |

| 1990 | $3,451 | $483 | $953 | $385 | $one,338 | $806 | $two,144 | $788 | $2,933 | $519 | |

| 1991 | $three,516 | $457 | $943 | $400 | $1,343 | $832 | $two,175 | $809 | $ii,984 | $532 | |

| 1992 | $3,681 | $524 | $1,031 | $413 | $i,444 | $856 | $2,299 | $832 | $3,131 | $549 | |

| 1993 | $three,776 | $521 | $1,048 | $426 | $i,474 | $883 | $2,358 | $854 | $iii,212 | $563 | |

| 1994 | $3,961 | $547 | $i,103 | $449 | $1,552 | $929 | $two,481 | $890 | $iii,371 | $590 | |

| 1995 | $4,245 | $620 | $ane,223 | $482 | $ane,705 | $985 | $2,690 | $938 | $iii,628 | $617 | |

| 1996 | $four,591 | $737 | $ane,394 | $515 | $1,909 | $1,043 | $two,953 | $992 | $iii,944 | $646 | |

| 1997 | $5,023 | $873 | $i,597 | $554 | $two,151 | $1,116 | $3,268 | $one,060 | $4,328 | $695 | |

| 1998 | $5,469 | $1,010 | $one,797 | $597 | $2,394 | $one,196 | $3,590 | $1,132 | $iv,721 | $748 | |

| 1999 | $5,909 | $1,153 | $ii,012 | $641 | $2,653 | $1,274 | $3,927 | $ane,199 | $5,126 | $783 | |

| 2000 | $6,424 | $1,337 | $ii,267 | $688 | $2,955 | $1,358 | $4,314 | $one,276 | $5,590 | $834 | |

| The IRS changed methodology, and then data above and below this line is not strictly comparable. | |||||||||||

| 2001 | $6,116 | $492 | $1,065 | $ane,934 | $666 | $2,600 | $1,334 | $3,933 | $1,302 | $5,235 | $881 |

| 2002 | $5,982 | $421 | $960 | $1,812 | $660 | $2,472 | $1,339 | $3,812 | $1,303 | $five,115 | $867 |

| 2003 | $vi,157 | $466 | $i,030 | $1,908 | $679 | $2,587 | $1,375 | $3,962 | $1,325 | $5,287 | $870 |

| 2004 | $half dozen,735 | $615 | $1,279 | $two,243 | $725 | $2,968 | $ane,455 | $iv,423 | $1,403 | $5,826 | $908 |

| 2005 | $seven,366 | $784 | $ane,561 | $2,623 | $778 | $iii,401 | $ane,540 | $4,940 | $1,473 | $6,413 | $953 |

| 2006 | $7,970 | $895 | $i,761 | $2,918 | $841 | $3,760 | $1,652 | $5,412 | $1,568 | $half dozen,980 | $990 |

| 2007 | $8,622 | $1,030 | $1,971 | $iii,223 | $905 | $iv,128 | $1,770 | $5,898 | $one,673 | $7,571 | $1,051 |

| 2008 | $eight,206 | $826 | $one,657 | $2,868 | $905 | $3,773 | $1,782 | $v,555 | $1,673 | $seven,228 | $978 |

| 2009 | $7,579 | $602 | $i,305 | $2,439 | $878 | $iii,317 | $i,740 | $5,058 | $1,620 | $6,678 | $900 |

| 2010 | $eight,040 | $743 | $1,517 | $2,716 | $915 | $3,631 | $1,800 | $5,431 | $ane,665 | $7,096 | $944 |

| 2011 | $8,317 | $737 | $1,556 | $ii,819 | $956 | $3,775 | $1,866 | $5,641 | $one,716 | $seven,357 | $961 |

| 2012 | $9,042 | $1,017 | $1,977 | $3,331 | $997 | $four,328 | $1,934 | $half-dozen,262 | $ane,776 | $8,038 | $1,004 |

| 2013 | $9,034 | $816 | $1,720 | $3,109 | $1,034 | $4,143 | $2,008 | $6,152 | $1,844 | $7,996 | $one,038 |

| 2014 | $9,709 | $986 | $1,998 | $iii,491 | $1,093 | $4,583 | $ii,107 | $6,690 | $ane,924 | $8,615 | $one,094 |

| 2015 | $10,143 | $ane,033 | $ii,095 | $three,659 | $1,145 | $iv,803 | $ii,194 | $half-dozen,998 | $ii,000 | $8,998 | $one,145 |

| 2016 | $10,157 | $966 | $two,003 | $3,575 | $i,155 | $four,729 | $2,221 | $half dozen,950 | $2,030 | $viii,980 | $1,177 |

| 2017 | $10,937 | $one,150 | $ii,301 | $3,995 | $1,226 | $v,221 | $2,340 | $7,561 | $2,145 | $ix,706 | $1,230 |

| 2018 | $xi,564 | $one,197 | $two,420 | $4,218 | $1,293 | $v,511 | $ii,458 | $7,969 | $2,253 | $x,222 | $1,342 |

| 2019 | $xi,883 | $1,141 | $two,393 | $4,270 | $i,351 | $v,621 | $two,556 | $8,177 | $ii,340 | $x,517 | $1,366 |

| Source: IRS, Statistics of Income, Private Income Rates and Tax Shares (2019). | |||||||||||

| Year | Total | Superlative 0.1% | Top one% | Top 5% | Between five% & ten% | Elevation 10% | Betwixt 10% & 25% | Top 25% | Between 25% & 50% | Acme 50% | Bottom l% |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1980 | $249 | $47 | $92 | $31 | $123 | $59 | $182 | $50 | $232 | $18 | |

| 1981 | $282 | $50 | $99 | $36 | $135 | $69 | $204 | $57 | $261 | $21 | |

| 1982 | $276 | $53 | $100 | $34 | $134 | $66 | $200 | $56 | $256 | $twenty | |

| 1983 | $272 | $55 | $101 | $34 | $135 | $64 | $199 | $54 | $252 | $19 | |

| 1984 | $297 | $63 | $113 | $37 | $150 | $68 | $219 | $57 | $276 | $22 | |

| 1985 | $322 | $70 | $125 | $41 | $166 | $73 | $238 | $lx | $299 | $23 | |

| 1986 | $367 | $94 | $156 | $44 | $201 | $78 | $279 | $64 | $343 | $24 | |

| The Tax Reform Act of 1986 changed the definition of AGI, so data to a higher place and below this line is not strictly comparable. | |||||||||||

| 1987 | $369 | $92 | $160 | $46 | $205 | $79 | $284 | $63 | $347 | $22 | |

| 1988 | $413 | $114 | $188 | $48 | $236 | $85 | $321 | $68 | $389 | $24 | |

| 1989 | $433 | $109 | $190 | $51 | $241 | $93 | $334 | $73 | $408 | $25 | |

| 1990 | $447 | $112 | $195 | $52 | $248 | $97 | $344 | $77 | $421 | $26 | |

| 1991 | $448 | $111 | $194 | $56 | $250 | $96 | $347 | $77 | $424 | $25 | |

| 1992 | $476 | $131 | $218 | $58 | $276 | $97 | $374 | $78 | $452 | $24 | |

| 1993 | $503 | $146 | $238 | $60 | $298 | $101 | $399 | $eighty | $479 | $24 | |

| 1994 | $535 | $154 | $254 | $64 | $318 | $108 | $425 | $84 | $509 | $25 | |

| 1995 | $588 | $178 | $288 | $seventy | $357 | $115 | $473 | $88 | $561 | $27 | |

| 1996 | $658 | $213 | $335 | $76 | $411 | $124 | $535 | $95 | $630 | $28 | |

| 1997 | $727 | $241 | $377 | $82 | $460 | $134 | $594 | $102 | $696 | $31 | |

| 1998 | $788 | $274 | $425 | $88 | $513 | $139 | $652 | $103 | $755 | $33 | |

| 1999 | $877 | $317 | $486 | $97 | $583 | $150 | $733 | $109 | $842 | $35 | |

| 2000 | $981 | $367 | $554 | $106 | $660 | $164 | $824 | $118 | $942 | $38 | |

| The IRS inverse methodology, then data higher up and beneath this line is non strictly comparable. | |||||||||||

| 2001 | $885 | $139 | $294 | $462 | $101 | $564 | $158 | $722 | $120 | $842 | $43 |

| 2002 | $794 | $120 | $263 | $420 | $93 | $513 | $143 | $657 | $104 | $761 | $33 |

| 2003 | $746 | $115 | $251 | $399 | $85 | $484 | $133 | $617 | $98 | $715 | $30 |

| 2004 | $829 | $142 | $301 | $467 | $91 | $558 | $137 | $695 | $102 | $797 | $32 |

| 2005 | $932 | $176 | $361 | $549 | $98 | $647 | $145 | $793 | $106 | $898 | $33 |

| 2006 | $i,020 | $196 | $402 | $607 | $108 | $715 | $157 | $872 | $113 | $986 | $35 |

| 2007 | $one,112 | $221 | $443 | $666 | $117 | $783 | $170 | $953 | $122 | $ane,075 | $37 |

| 2008 | $i,029 | $187 | $386 | $597 | $115 | $712 | $168 | $880 | $117 | $997 | $32 |

| 2009 | $863 | $146 | $314 | $502 | $101 | $604 | $146 | $749 | $93 | $842 | $21 |

| 2010 | $949 | $170 | $355 | $561 | $110 | $670 | $156 | $827 | $100 | $927 | $22 |

| 2011 | $1,043 | $168 | $366 | $589 | $123 | $712 | $181 | $893 | $120 | $one,012 | $xxx |

| 2012 | $ane,185 | $220 | $451 | $699 | $133 | $831 | $193 | $1,024 | $128 | $1,152 | $33 |

| 2013 | $1,232 | $228 | $466 | $721 | $139 | $860 | $203 | $1,063 | $135 | $1,198 | $34 |

| 2014 | $1,374 | $273 | $543 | $824 | $150 | $974 | $219 | $1,193 | $144 | $ane,337 | $38 |

| 2015 | $1,454 | $284 | $568 | $866 | $160 | $1,027 | $233 | $1,260 | $154 | $1,413 | $41 |

| 2016 | $1,442 | $261 | $538 | $840 | $162 | $one,002 | $238 | $i,240 | $159 | $1,399 | $44 |

| 2017 | $ane,601 | $310 | $616 | $947 | $175 | $one,122 | $257 | $ane,379 | $173 | $1,552 | $50 |

| 2018 | $1,536 | $311 | $616 | $926 | $170 | $1,096 | $240 | $ane,336 | $155 | $ane,491 | $45 |

| 2019 | $1,579 | $298 | $612 | $938 | $179 | $ane,118 | $250 | $1,368 | $162 | $1,530 | $48 |

| Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares | |||||||||||

| Yr | Total | Meridian 0.one% | Top 1% | Top 5% | Between 5% & ten% | Top x% | Between x% & 25% | Top 25% | Betwixt 25% & 50% | Top 50% | Bottom l% |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1980 | 100% | 8.46% | 21.01% | xi.12% | 32.13% | 24.57% | 56.lxx% | 25.62% | 82.32% | 17.68% | |

| 1981 | 100% | eight.30% | 20.78% | eleven.20% | 31.98% | 24.69% | 56.67% | 25.59% | 82.25% | 17.75% | |

| 1982 | 100% | 8.91% | 21.23% | 11.03% | 32.26% | 24.53% | 56.79% | 25.l% | 82.29% | 17.71% | |

| 1983 | 100% | 9.29% | 21.74% | 11.04% | 32.78% | 24.44% | 57.22% | 25.30% | 82.52% | 17.48% | |

| 1984 | 100% | 9.66% | 22.nineteen% | xi.06% | 33.25% | 24.31% | 57.56% | 25.00% | 82.56% | 17.44% | |

| 1985 | 100% | x.03% | 22.67% | eleven.10% | 33.77% | 24.21% | 57.97% | 24.77% | 82.74% | 17.26% | |

| 1986 | 100% | 11.xxx% | 24.11% | 11.02% | 35.12% | 23.92% | 59.04% | 24.thirty% | 83.34% | xvi.66% | |

| The Tax Reform Act of 1986 changed the definition of AGI, so data to a higher place and below this line is not strictly comparable. | |||||||||||

| 1987 | 100% | 12.32% | 25.67% | xi.23% | 36.xc% | 23.85% | 60.75% | 23.62% | 84.37% | 15.63% | |

| 1988 | 100% | 15.16% | 28.51% | x.94% | 39.45% | 22.99% | 62.44% | 22.63% | 85.07% | 14.93% | |

| 1989 | 100% | 14.nineteen% | 27.84% | eleven.16% | 39.00% | 23.28% | 62.28% | 22.76% | 85.04% | 14.96% | |

| 1990 | 100% | xiv.00% | 27.62% | xi.15% | 38.77% | 23.36% | 62.13% | 22.84% | 84.97% | 15.03% | |

| 1991 | 100% | 12.99% | 26.83% | 11.37% | 38.20% | 23.65% | 61.85% | 23.01% | 84.87% | 15.13% | |

| 1992 | 100% | 14.23% | 28.01% | 11.21% | 39.23% | 23.25% | 62.47% | 22.61% | 85.08% | 14.92% | |

| 1993 | 100% | 13.79% | 27.76% | eleven.29% | 39.05% | 23.40% | 62.45% | 22.63% | 85.08% | 14.92% | |

| 1994 | 100% | 13.80% | 27.85% | 11.34% | 39.xix% | 23.45% | 62.64% | 22.48% | 85.eleven% | xiv.89% | |

| 1995 | 100% | 14.60% | 28.81% | xi.35% | 40.16% | 23.21% | 63.37% | 22.09% | 85.46% | xiv.54% | |

| 1996 | 100% | sixteen.04% | 30.36% | 11.23% | 41.59% | 22.73% | 64.32% | 21.60% | 85.92% | 14.08% | |

| 1997 | 100% | 17.38% | 31.79% | xi.03% | 42.83% | 22.22% | 65.05% | 21.11% | 86.16% | 13.84% | |

| 1998 | 100% | 18.47% | 32.85% | 10.92% | 43.77% | 21.87% | 65.63% | twenty.69% | 86.33% | 13.67% | |

| 1999 | 100% | 19.51% | 34.04% | 10.85% | 44.89% | 21.57% | 66.46% | 20.29% | 86.75% | 13.25% | |

| 2000 | 100% | 20.81% | 35.30% | 10.71% | 46.01% | 21.15% | 67.15% | xix.86% | 87.01% | 12.99% | |

| The IRS changed methodology, so information above and below this line is not strictly comparable. | |||||||||||

| 2001 | 100% | 8.05% | 17.41% | 31.61% | x.89% | 42.50% | 21.80% | 64.31% | 21.29% | 85.threescore% | xiv.40% |

| 2002 | 100% | 7.04% | xvi.05% | 30.29% | 11.04% | 41.33% | 22.39% | 63.71% | 21.79% | 85.50% | fourteen.fifty% |

| 2003 | 100% | seven.56% | 16.73% | 30.99% | xi.03% | 42.01% | 22.33% | 64.34% | 21.52% | 85.87% | xiv.thirteen% |

| 2004 | 100% | 9.14% | 18.99% | 33.31% | 10.77% | 44.07% | 21.lx% | 65.68% | 20.83% | 86.51% | 13.49% |

| 2005 | 100% | ten.64% | 21.nineteen% | 35.61% | x.56% | 46.17% | xx.90% | 67.07% | 19.99% | 87.06% | 12.94% |

| 2006 | 100% | 11.23% | 22.10% | 36.62% | x.56% | 47.17% | 20.73% | 67.91% | 19.68% | 87.58% | 12.42% |

| 2007 | 100% | 11.95% | 22.86% | 37.39% | x.49% | 47.88% | 20.53% | 68.41% | 19.twoscore% | 87.81% | 12.19% |

| 2008 | 100% | 10.06% | twenty.xix% | 34.95% | 11.03% | 45.98% | 21.71% | 67.69% | 20.39% | 88.08% | 11.92% |

| 2009 | 100% | seven.94% | 17.21% | 32.eighteen% | xi.59% | 43.77% | 22.96% | 66.74% | 21.38% | 88.12% | 11.88% |

| 2010 | 100% | ix.24% | eighteen.87% | 33.78% | 11.38% | 45.17% | 22.38% | 67.55% | 20.71% | 88.26% | xi.74% |

| 2011 | 100% | 8.86% | eighteen.70% | 33.89% | xi.l% | 45.39% | 22.43% | 67.82% | 20.63% | 88.45% | 11.55% |

| 2012 | 100% | 11.25% | 21.86% | 36.84% | 11.03% | 47.87% | 21.39% | 69.25% | xix.64% | 88.90% | xi.ten% |

| 2013 | 100% | 9.03% | 19.04% | 34.42% | 11.45% | 45.87% | 22.23% | 68.10% | xx.41% | 88.51% | 11.49% |

| 2014 | 100% | 10.sixteen% | 20.58% | 35.96% | 11.25% | 47.21% | 21.70% | 68.91% | xix.82% | 88.73% | eleven.27% |

| 2015 | 100% | 10.xix% | 20.65% | 36.07% | xi.29% | 47.36% | 21.64% | 68.99% | 19.72% | 88.72% | 11.28% |

| 2016 | 100% | nine.52% | nineteen.72% | 35.20% | 11.37% | 46.56% | 21.86% | 68.43% | 19.98% | 88.41% | 11.59% |

| 2017 | 100% | x.52% | 21.04% | 36.53% | eleven.21% | 47.74% | 21.40% | 69.14% | 19.61% | 88.75% | 11.25% |

| 2018 | 100% | ten.35% | 20.93% | 36.48% | 11.xviii% | 47.66% | 21.26% | 68.91% | nineteen.48% | 88.39% | 11.61% |

| 2019 | 100% | 9.60% | 20.14% | 35.93% | xi.37% | 47.30% | 21.51% | 68.82% | 19.69% | 88.51% | 11.49% |

| Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares | |||||||||||

| Twelvemonth | Total | Top 0.1% | Top ane% | Elevation v% | Between v% & 10% | Top 10% | Betwixt 10% & 25% | Top 25% | Between 25% & 50% | Pinnacle l% | Bottom 50% |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1980 | 100% | 19.05% | 36.84% | 12.44% | 49.28% | 23.74% | 73.02% | 19.93% | 92.95% | 7.05% | |

| 1981 | 100% | 17.58% | 35.06% | 12.xc% | 47.96% | 24.33% | 72.29% | twenty.26% | 92.55% | 7.45% | |

| 1982 | 100% | 19.03% | 36.thirteen% | 12.45% | 48.59% | 23.91% | 72.fifty% | twenty.15% | 92.65% | 7.35% | |

| 1983 | 100% | 20.32% | 37.26% | 12.44% | 49.71% | 23.39% | 73.x% | nineteen.73% | 92.83% | vii.17% | |

| 1984 | 100% | 21.12% | 37.98% | 12.58% | 50.56% | 22.92% | 73.49% | 19.16% | 92.65% | vii.35% | |

| 1985 | 100% | 21.81% | 38.78% | 12.67% | 51.46% | 22.60% | 74.06% | 18.77% | 92.83% | seven.17% | |

| 1986 | 100% | 25.75% | 42.57% | 12.12% | 54.69% | 21.33% | 76.02% | 17.52% | 93.54% | 6.46% | |

| The Tax Reform Human action of 1986 changed the definition of AGI, and then data above and below this line is not strictly comparable. | |||||||||||

| 1987 | 100% | 24.81% | 43.26% | 12.35% | 55.61% | 21.31% | 76.92% | 17.02% | 93.93% | 6.07% | |

| 1988 | 100% | 27.58% | 45.62% | 11.66% | 57.28% | twenty.57% | 77.84% | sixteen.44% | 94.28% | 5.72% | |

| 1989 | 100% | 25.24% | 43.94% | 11.85% | 55.78% | 21.44% | 77.22% | xvi.94% | 94.17% | five.83% | |

| 1990 | 100% | 25.13% | 43.64% | 11.73% | 55.36% | 21.66% | 77.02% | 17.16% | 94.19% | five.81% | |

| 1991 | 100% | 24.82% | 43.38% | 12.45% | 55.82% | 21.46% | 77.29% | 17.23% | 94.52% | 5.48% | |

| 1992 | 100% | 27.54% | 45.88% | 12.12% | 58.01% | 20.47% | 78.48% | 16.46% | 94.94% | 5.06% | |

| 1993 | 100% | 29.01% | 47.36% | xi.88% | 59.24% | 20.03% | 79.27% | xv.92% | 95.xix% | iv.81% | |

| 1994 | 100% | 28.86% | 47.52% | 11.93% | 59.45% | 20.ten% | 79.55% | 15.68% | 95.23% | 4.77% | |

| 1995 | 100% | 30.26% | 48.91% | xi.84% | 60.75% | nineteen.62% | 80.36% | 15.03% | 95.39% | 4.61% | |

| 1996 | 100% | 32.31% | 50.97% | 11.54% | 62.51% | 18.80% | 81.32% | 14.36% | 95.68% | iv.32% | |

| 1997 | 100% | 33.17% | 51.87% | xi.33% | 63.20% | eighteen.47% | 81.67% | 14.05% | 95.72% | 4.28% | |

| 1998 | 100% | 34.75% | 53.84% | 11.20% | 65.04% | 17.65% | 82.69% | xiii.x% | 95.79% | 4.21% | |

| 1999 | 100% | 36.18% | 55.45% | 11.00% | 66.45% | 17.09% | 83.54% | 12.46% | 96.00% | 4.00% | |

| 2000 | 100% | 37.42% | 56.47% | x.86% | 67.33% | 16.68% | 84.01% | 12.08% | 96.09% | 3.91% | |

| The IRS changed methodology, so data above and below this line is non strictly comparable. | |||||||||||

| 2001 | 100% | 15.68% | 33.22% | 52.24% | 11.44% | 63.68% | 17.88% | 81.56% | 13.54% | 95.ten% | 4.ninety% |

| 2002 | 100% | 15.09% | 33.09% | 52.86% | 11.77% | 64.63% | xviii.04% | 82.67% | thirteen.12% | 95.79% | 4.21% |

| 2003 | 100% | 15.37% | 33.69% | 53.54% | 11.35% | 64.89% | 17.87% | 82.76% | xiii.17% | 95.93% | 4.07% |

| 2004 | 100% | 17.12% | 36.28% | 56.35% | 10.96% | 67.thirty% | 16.52% | 83.82% | 12.31% | 96.13% | three.87% |

| 2005 | 100% | 18.91% | 38.78% | 58.93% | x.52% | 69.46% | 15.61% | 85.07% | 11.35% | 96.41% | 3.59% |

| 2006 | 100% | 19.24% | 39.36% | 59.49% | 10.59% | 70.08% | xv.41% | 85.49% | eleven.10% | 96.59% | three.41% |

| 2007 | 100% | 19.84% | 39.81% | 59.90% | 10.51% | 70.41% | 15.xxx% | 85.71% | ten.93% | 96.64% | iii.36% |

| 2008 | 100% | 18.20% | 37.51% | 58.06% | 11.14% | 69.20% | 16.37% | 85.57% | 11.33% | 96.90% | iii.ten% |

| 2009 | 100% | 16.91% | 36.34% | 58.17% | 11.72% | 69.89% | sixteen.85% | 86.74% | 10.80% | 97.54% | ii.46% |

| 2010 | 100% | 17.88% | 37.38% | 59.07% | 11.55% | 70.62% | 16.49% | 87.xi% | 10.53% | 97.64% | two.36% |

| 2011 | 100% | xvi.14% | 35.06% | 56.49% | xi.77% | 68.26% | 17.36% | 85.62% | 11.50% | 97.11% | ii.89% |

| 2012 | 100% | 18.60% | 38.09% | 58.95% | 11.22% | 70.17% | 16.25% | 86.42% | 10.eighty% | 97.22% | 2.78% |

| 2013 | 100% | 18.48% | 37.fourscore% | 58.55% | eleven.25% | 69.eighty% | 16.47% | 86.27% | 10.94% | 97.22% | 2.78% |

| 2014 | 100% | xix.85% | 39.48% | 59.97% | 10.91% | 70.88% | 15.90% | 86.78% | 10.47% | 97.25% | two.75% |

| 2015 | 100% | xix.fifty% | 39.04% | 59.58% | 11.01% | 70.59% | 16.03% | 86.62% | 10.55% | 97.17% | 2.83% |

| 2016 | 100.00% | xviii.12% | 37.32% | 58.23% | xi.24% | 69.47% | 16.fifty% | 85.97% | 10.99% | 96.96% | three.04% |

| 2017 | 100.00% | 19.34% | 38.47% | 59.14% | 10.94% | 70.08% | 16.02% | 86.ten% | ten.79% | 96.89% | 3.11% |

| 2018 | 100.00% | 20.22% | 40.08% | 60.30% | eleven.06% | 71.37% | 15.60% | 86.97% | ten.09% | 97.06% | 2.94% |

| 2019 | 100.00% | 18.87% | 38.77% | 59.44% | eleven.37% | 70.81% | 15.84% | 86.65% | 10.29% | 96.94% | 3.06% |

| Source: IRS, Statistics of Income, Individual Income Rates and Revenue enhancement Shares | |||||||||||

| Twelvemonth | Top 0.1% | Acme ane% | Meridian five% | Top x% | Top 25% | Top 50% |

|---|---|---|---|---|---|---|

| 1980 | $eighty,580 | $43,792 | $35,070 | $23,606 | $12,936 | |

| 1981 | $85,428 | $47,845 | $38,283 | $25,655 | $14,000 | |

| 1982 | $89,388 | $49,284 | $39,676 | $27,027 | $fourteen,539 | |

| 1983 | $93,512 | $51,553 | $41,222 | $27,827 | $15,044 | |

| 1984 | $100,889 | $55,423 | $43,956 | $29,360 | $15,998 | |

| 1985 | $108,134 | $58,883 | $46,322 | $thirty,928 | $16,688 | |

| 1986 | $118,818 | $62,377 | $48,656 | $32,242 | $17,302 | |

| The Revenue enhancement Reform Human action of 1986 changed the definition of AGI, so data to a higher place and below this line is not strictly comparable. | ||||||

| 1987 | $139,289 | $68,414 | $52,921 | $33,983 | $17,768 | |

| 1988 | $157,136 | $72,735 | $55,437 | $35,398 | $18,367 | |

| 1989 | $163,869 | $76,933 | $58,263 | $36,839 | $18,993 | |

| 1990 | $167,421 | $79,064 | $60,287 | $38,080 | $nineteen,767 | |

| 1991 | $170,139 | $81,720 | $61,944 | $38,929 | $20,097 | |

| 1992 | $181,904 | $85,103 | $64,457 | $40,378 | $xx,803 | |

| 1993 | $185,715 | $87,386 | $66,077 | $41,210 | $21,179 | |

| 1994 | $195,726 | $91,226 | $68,753 | $42,742 | $21,802 | |

| 1995 | $209,406 | $96,221 | $72,094 | $44,207 | $22,344 | |

| 1996 | $227,546 | $101,141 | $74,986 | $45,757 | $23,174 | |

| 1997 | $250,736 | $108,048 | $79,212 | $48,173 | $24,393 | |

| 1998 | $269,496 | $114,729 | $83,220 | $fifty,607 | $25,491 | |

| 1999 | $293,415 | $120,846 | $87,682 | $52,965 | $26,415 | |

| 2000 | $313,469 | $128,336 | $92,144 | $55,225 | $27,682 | |

| The IRS changed methodology, and then data above and below this line is not strictly comparable. | ||||||

| 2001 | $1,393,718 | $306,635 | $132,082 | $96,151 | $59,026 | $31,418 |

| 2002 | $1,245,352 | $296,194 | $130,750 | $95,699 | $59,066 | $31,299 |

| 2003 | $1,317,088 | $305,939 | $133,741 | $97,470 | $59,896 | $31,447 |

| 2004 | $1,617,918 | $339,993 | $140,758 | $101,838 | $62,794 | $32,622 |

| 2005 | $1,938,175 | $379,261 | $149,216 | $106,864 | $64,821 | $33,484 |

| 2006 | $2,124,625 | $402,603 | $157,390 | $112,016 | $67,291 | $34,417 |

| 2007 | $2,251,017 | $426,439 | $164,883 | $116,396 | $69,559 | $35,541 |

| 2008 | $i,867,652 | $392,513 | $163,512 | $116,813 | $69,813 | $35,340 |

| 2009 | $1,469,393 | $351,968 | $157,342 | $114,181 | $68,216 | $34,156 |

| 2010 | $1,634,386 | $369,691 | $161,579 | $116,623 | $69,126 | $34,338 |

| 2011 | $1,717,675 | $388,905 | $167,728 | $120,136 | $lxx,492 | $34,823 |

| 2012 | $two,161,175 | $434,682 | $175,817 | $125,195 | $73,354 | $36,055 |

| 2013 | $1,860,848 | $428,713 | $179,760 | $127,695 | $74,955 | $36,841 |

| 2014 | $2,136,762 | $465,626 | $188,996 | $133,445 | $77,714 | $38,173 |

| 2015 | $2,220,264 | $480,930 | $195,778 | $138,031 | $79,655 | $39,275 |

| 2016 | $ii,124,117 | $480,804 | $197,651 | $139,713 | $eighty,921 | $40,078 |

| 2017 | $2,374,937 | $515,371 | $208,053 | $145,135 | $83,682 | $41,740 |

| 2018 | $ii,514,209 | $540,009 | $217,913 | $151,935 | $87,044 | $43,614 |

| 2019 | $2,458,432 | $546,434 | $221,572 | $154,589 | $87,917 | $44,269 |

| Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares | ||||||

| Yr | Total | Height 0.1% | Meridian 1% | Top 5% | Betwixt 5% & 10% | Acme ten% | Between 10% & 25% | Summit 25% | Between 25% & fifty% | Tiptop l% | Bottom fifty% |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1980 | xv.31% | 34.47% | 26.85% | 17.13% | 23.49% | xiv.80% | nineteen.72% | 11.91% | 17.29% | 6.10% | |

| 1981 | 15.76% | 33.37% | 26.59% | xviii.sixteen% | 23.64% | 15.53% | 20.11% | 12.48% | 17.73% | 6.62% | |

| 1982 | xiv.72% | 31.43% | 25.05% | xvi.61% | 22.17% | 14.35% | xviii.79% | 11.63% | xvi.57% | half-dozen.ten% | |

| 1983 | 13.79% | thirty.18% | 23.64% | 15.54% | 20.91% | 13.20% | 17.62% | x.76% | 15.52% | 5.66% | |

| 1984 | xiii.68% | 29.92% | 23.42% | 15.57% | xx.81% | 12.90% | 17.47% | 10.48% | 15.35% | v.77% | |

| 1985 | 13.73% | 29.86% | 23.l% | 15.69% | 20.93% | 12.83% | 17.55% | x.41% | 15.41% | 5.lxx% | |

| 1986 | 14.54% | 33.13% | 25.68% | 15.99% | 22.64% | 12.97% | 18.72% | 10.48% | 16.32% | 5.63% | |

| The Tax Reform Act of 1986 changed the definition of AGI, so data to a higher place and below this line is not strictly comparable. | |||||||||||

| 1987 | 13.12% | 26.41% | 22.10% | 14.43% | 19.77% | 11.71% | 16.61% | 9.45% | 14.threescore% | v.09% | |

| 1988 | 13.21% | 24.04% | 21.xiv% | 14.07% | 19.18% | 11.82% | sixteen.47% | nine.60% | 14.64% | five.06% | |

| 1989 | xiii.12% | 23.34% | 20.71% | 13.93% | eighteen.77% | 12.08% | 16.27% | 9.77% | 14.53% | 5.xi% | |

| 1990 | 12.95% | 23.25% | 20.46% | 13.63% | eighteen.50% | 12.01% | 16.06% | 9.73% | 14.36% | 5.01% | |

| 1991 | 12.75% | 24.37% | 20.62% | 13.96% | eighteen.63% | 11.57% | 15.93% | nine.55% | fourteen.20% | 4.62% | |

| 1992 | 12.94% | 25.05% | 21.xix% | 13.99% | 19.thirteen% | 11.39% | 16.25% | 9.42% | 14.44% | four.39% | |

| 1993 | 13.32% | 28.01% | 22.71% | 14.01% | twenty.xx% | 11.40% | 16.90% | 9.37% | 14.90% | 4.29% | |

| 1994 | 13.50% | 28.23% | 23.04% | 14.20% | 20.48% | eleven.57% | 17.fifteen% | 9.42% | 15.xi% | 4.32% | |

| 1995 | thirteen.86% | 28.73% | 23.53% | 14.46% | 20.97% | 11.71% | 17.58% | 9.43% | 15.47% | four.39% | |

| 1996 | xiv.34% | 28.87% | 24.07% | 14.74% | 21.55% | 11.86% | 18.12% | nine.53% | 15.96% | 4.40% | |

| 1997 | 14.48% | 27.64% | 23.62% | 14.87% | 21.36% | 12.04% | eighteen.18% | 9.63% | sixteen.09% | 4.48% | |

| 1998 | 14.42% | 27.12% | 23.63% | fourteen.79% | 21.42% | xi.63% | 18.xvi% | 9.12% | 16.00% | 4.44% | |

| 1999 | 14.85% | 27.53% | 24.18% | 15.06% | 21.98% | 11.76% | 18.66% | 9.12% | 16.43% | four.48% | |

| 2000 | fifteen.26% | 27.45% | 24.42% | 15.48% | 22.34% | 12.04% | 19.09% | ix.28% | 16.86% | 4.sixty% | |

| The IRS inverse methodology, so data above and below this line is not strictly comparable. | |||||||||||

| 2001 | 14.47% | 28.17% | 27.60% | 23.91% | fifteen.20% | 21.68% | 11.87% | 18.35% | 9.xx% | 16.08% | 4.92% |

| 2002 | thirteen.28% | 28.48% | 27.37% | 23.17% | 14.15% | xx.76% | 10.lxx% | 17.23% | 8.00% | 14.87% | 3.86% |

| 2003 | 12.11% | 24.60% | 24.38% | 20.92% | 12.46% | 18.seventy% | 9.69% | fifteen.57% | 7.41% | 13.53% | iii.49% |

| 2004 | 12.31% | 23.06% | 23.52% | 20.83% | 12.53% | 18.lxxx% | 9.41% | fifteen.71% | 7.27% | xiii.68% | 3.53% |

| 2005 | 12.65% | 22.48% | 23.fifteen% | 20.93% | 12.61% | nineteen.03% | nine.45% | 16.04% | seven.eighteen% | 14.01% | three.51% |

| 2006 | 12.80% | 21.94% | 22.80% | 20.80% | 12.84% | 19.02% | 9.52% | xvi.12% | 7.22% | 14.12% | iii.51% |

| 2007 | 12.90% | 21.42% | 22.46% | 20.66% | 12.92% | xviii.96% | 9.61% | 16.sixteen% | 7.27% | 14.19% | 3.56% |

| 2008 | 12.54% | 22.67% | 23.29% | twenty.83% | 12.66% | 18.87% | 9.45% | 15.85% | 6.97% | thirteen.79% | 3.26% |

| 2009 | 11.39% | 24.28% | 24.05% | 20.59% | xi.53% | 18.xix% | 8.36% | xiv.81% | v.76% | 12.61% | 2.35% |

| 2010 | 11.81% | 22.84% | 23.39% | xx.64% | 11.98% | eighteen.46% | 8.seventy% | fifteen.22% | 6.01% | xiii.06% | 2.37% |

| 2011 | 12.54% | 22.82% | 23.50% | 20.89% | 12.83% | 18.85% | ix.seventy% | 15.82% | 6.98% | 13.76% | 3.13% |

| 2012 | 13.eleven% | 21.67% | 22.83% | twenty.97% | 13.33% | 19.21% | nine.96% | 16.35% | 7.21% | 14.33% | 3.28% |

| 2013 | 13.64% | 27.91% | 27.08% | 23.20% | 13.40% | 20.75% | 10.xi% | 17.28% | 7.31% | 14.98% | 3.30% |

| 2014 | 14.16% | 27.67% | 27.sixteen% | 23.61% | xiii.73% | 21.25% | 10.37% | 17.83% | 7.48% | xv.52% | 3.45% |

| 2015 | xiv.34% | 27.44% | 27.10% | 23.68% | 13.99% | 21.37% | 10.62% | 18.00% | vii.67% | 15.71% | 3.59% |

| 2016 | 14.20% | 27.05% | 26.87% | 23.49% | 14.05% | 21.xix% | 10.71% | 17.84% | seven.81% | xv.57% | three.73% |

| 2017 | 14.64% | 26.93% | 26.76% | 23.70% | xiv.29% | 21.49% | 10.96% | 18.23% | 8.06% | 15.99% | 4.05% |

| 2018 | 13.28% | 25.96% | 25.44% | 21.96% | 13.fourteen% | xix.89% | 9.75% | 16.77% | 6.88% | fourteen.59% | 3.36% |

| 2019 | xiii.29% | 26.12% | 25.57% | 21.98% | 13.28% | 19.89% | nine.78% | 16.73% | 6.94% | 14.55% | 3.54% |

| Source: IRS, Statistics of Income, Private Income Rates and Tax Shares | |||||||||||

| [All figures are estimates based on samples] | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Total | Descending cumulative percentiles | ||||||||||||||

| Peak 0.001 pct | Top 0.01 percentage | Top 0.1 percent | Top 1 percent | Top 2 pct | Top 3 percent | Top 4 percent | Height 5 pct | Superlative 10 percent | Top twenty percent | Top 25 percent | Summit 30 percent | Top 40 pct | Top 50 percent | ||

| Number of returns: | |||||||||||||||

| 2001 | 119,370,886 | 1,194 | xi,937 | 119,371 | one,193,709 | 2,387,418 | 3,581,127 | 4,774,835 | v,968,544 | 11,937,089 | 23,874,177 | 29,842,722 | 35,811,266 | 47,748,354 | 59,685,443 |

| 2002 | 119,850,561 | 1,199 | 11,985 | 119,851 | 1,198,506 | 2,397,011 | 3,595,517 | 4,794,022 | 5,992,528 | 11,985,056 | 23,970,112 | 29,962,640 | 35,955,168 | 47,940,224 | 59,925,281 |

| 2003 | 120,758,947 | 1,208 | 12,076 | 120,759 | i,207,589 | 2,415,179 | three,622,768 | iv,830,358 | 6,037,947 | 12,075,895 | 24,151,789 | xxx,189,737 | 36,227,684 | 48,303,579 | lx,379,474 |

| 2004 | 122,509,974 | ane,225 | 12,251 | 122,510 | 1,225,100 | two,450,199 | iii,675,299 | 4,900,399 | six,125,499 | 12,250,997 | 24,501,995 | xxx,627,494 | 36,752,992 | 49,003,990 | 61,254,987 |

| 2005 | 124,673,055 | one,247 | 12,467 | 124,673 | ane,246,731 | two,493,461 | 3,740,192 | 4,986,922 | 6,233,653 | 12,467,306 | 24,934,611 | 31,168,264 | 37,401,917 | 49,869,222 | 62,336,528 |

| 2006 | 128,441,165 | 1,284 | 12,844 | 128,441 | 1,284,412 | two,568,823 | 3,853,235 | v,137,647 | 6,422,058 | 12,844,117 | 25,688,233 | 32,110,291 | 38,532,350 | 51,376,466 | 64,220,583 |

| 2007 | [four] 132,654,911 | [iv] 1,327 | [4] xiii,265 | 132,654 | 1,326,549 | two,653,098 | 3,979,647 | v,306,196 | 6,632,746 | 13,265,491 | 26,530,982 | 33,163,728 | 39,796,473 | 53,061,964 | 66,327,456 |

| 2008 | 132,891,770 | 1,329 | thirteen,289 | 132,892 | 1,328,918 | 2,657,835 | 3,986,753 | 5,315,671 | vi,644,589 | xiii,289,177 | 26,578,354 | 33,222,943 | 39,867,531 | 53,156,708 | 66,445,885 |

| 2009 | 132,619,936 | ane,326 | 13,262 | 132,620 | 1,326,199 | 2,652,399 | 3,978,598 | v,304,797 | half-dozen,630,997 | thirteen,261,994 | 26,523,987 | 33,154,984 | 39,785,981 | 53,047,974 | 66,309,968 |

| 2010 | 135,033,492 | i,350 | 13,503 | 135,033 | 1,350,335 | 2,700,670 | 4,051,005 | 5,401,340 | 6,751,675 | thirteen,503,349 | 27,006,698 | 33,758,373 | twoscore,510,048 | 54,013,397 | 67,516,746 |

| 2011 | 136,585,712 | 1,366 | 13,659 | 136,586 | 1,365,857 | 2,731,714 | 4,097,571 | 5,463,428 | 6,829,286 | xiii,658,571 | 27,317,142 | 34,146,428 | twoscore,975,714 | 54,634,285 | 68,292,856 |

| 2012 | 136,080,353 | 1,361 | thirteen,608 | 136,080 | 1,360,804 | 2,721,607 | 4,082,411 | 5,443,214 | 6,804,018 | 13,608,035 | 27,216,071 | 34,020,088 | 40,824,106 | 54,432,141 | 68,040,177 |

| 2013 | 138,313,155 | 1,383 | thirteen,831 | 138,313 | 1,383,132 | two,766,263 | iv,149,395 | 5,532,526 | 6,915,658 | xiii,831,316 | 27,662,631 | 34,578,289 | 41,493,947 | 55,325,262 | 69,156,578 |

| 2014 | 139,562,034 | 1,396 | xiii,956 | 139,562 | i,395,620 | 2,791,241 | four,186,861 | v,582,481 | half dozen,978,102 | xiii,956,203 | 27,912,407 | 34,890,509 | 41,868,610 | 55,824,814 | 69,781,017 |

| 2015 | 141,204,625 | 1,412 | 14,120 | 141,205 | i,412,046 | 2,824,093 | 4,236,139 | 5,648,185 | 7,060,231 | 14,120,463 | 28,240,925 | 35,301,156 | 42,361,388 | 56,481,850 | 70,602,313 |

| 2016 | 140,888,785 | one,409 | xiv,089 | 140,889 | 1,408,888 | two,817,776 | iv,226,664 | v,635,551 | 7,044,439 | 14,088,879 | 28,177,757 | 35,222,196 | 42,266,636 | 56,355,514 | 70,444,393 |

| 2017 | 143,295,160 | 1,433 | 14,330 | 143,295 | one,432,952 | 2,865,903 | 4,298,855 | five,731,806 | seven,164,758 | 14,329,516 | 28,659,032 | 35,823,790 | 42,988,548 | 57,318,064 | 71,647,580 |

| 2018 | 144,317,866 | 1,443 | 14,432 | 144,318 | i,443,179 | 2,886,357 | 4,329,536 | 5,772,715 | 7,215,893 | 14,431,787 | 28,863,573 | 36,079,467 | 43,295,360 | 57,727,146 | 72,158,933 |

| 2019 | 148,245,929 | 1,482 | 14,825 | 148,246 | i,482,459 | 2,964,919 | four,447,378 | 5,929,837 | 7,412,296 | 14,824,593 | 29,649,186 | 37,061,482 | 44,473,779 | 59,298,372 | 74,122,965 |

| Adjusted gross income floor on percentiles (electric current dollars): | |||||||||||||||

| 2001 | N/A | 31,331,335 | 6,869,952 | 1,393,718 | 306,635 | 207,592 | 167,788 | 145,667 | 132,082 | 96,151 | 67,818 | 59,026 | 51,863 | 40,293 | 31,418 |

| 2002 | N/A | 25,921,482 | 5,891,214 | 1,245,352 | 296,194 | 200,654 | 164,409 | 144,575 | 130,750 | 95,699 | 67,928 | 59,066 | 51,721 | 40,073 | 31,299 |

| 2003 | N/A | 28,489,160 | 6,386,149 | i,317,088 | 305,939 | 205,565 | 168,248 | 147,132 | 133,741 | 97,470 | 69,304 | 59,896 | 52,353 | twoscore,383 | 31,447 |

| 2004 | N/A | 38,780,500 | 8,455,107 | 1,617,918 | 339,993 | 224,320 | 181,127 | 156,665 | 140,758 | 101,838 | 72,069 | 62,794 | 54,765 | 42,081 | 32,622 |

| 2005 | Due north/A | 50,796,495 | ten,738,867 | 1,938,175 | 379,261 | 245,392 | 194,726 | 167,281 | 149,216 | 106,864 | 74,790 | 64,821 | 56,583 | 43,361 | 33,484 |

| 2006 | N/A | 54,665,360 | eleven,649,460 | 2,124,625 | 402,603 | 258,800 | 205,835 | 176,455 | 157,390 | 112,016 | 77,776 | 67,291 | 58,505 | 44,748 | 34,417 |

| 2007 | N/A | 62,955,875 | 12,747,384 | 2,251,017 | 426,439 | 270,440 | 214,832 | 184,473 | 164,883 | 116,396 | lxxx,723 | 69,559 | lx,617 | 46,200 | 35,541 |

| 2008 | N/A | 49,546,782 | 10,097,827 | 1,867,652 | 392,513 | 260,381 | 209,750 | 181,624 | 163,512 | 116,813 | fourscore,886 | 69,813 | sixty,535 | 46,120 | 35,340 |

| 2009 | N/A | 34,381,494 | 7,206,540 | 1,469,393 | 351,968 | 243,096 | 198,731 | 174,432 | 157,342 | 114,181 | 79,237 | 68,216 | 58,876 | 44,529 | 34,156 |

| 2010 | Due north/A | 45,039,369 | 8,762,618 | 1,634,386 | 369,691 | 252,785 | 205,942 | 179,023 | 161,579 | 116,623 | 80,462 | 69,126 | 59,512 | 44,895 | 34,338 |

| 2011 | N/A | 41,965,258 | viii,830,028 | 1,717,675 | 388,905 | 262,933 | 213,441 | 185,812 | 167,728 | 120,136 | 82,241 | 70,492 | 60,789 | 45,722 | 34,823 |

| 2012 | N/A | 62,068,187 | 12,104,014 | ii,161,175 | 434,682 | 285,908 | 227,923 | 196,416 | 175,817 | 125,195 | 85,440 | 73,354 | 63,222 | 47,475 | 36,055 |

| 2013 | N/A | 45,097,112 | 9,460,540 | i,860,848 | 428,713 | 287,018 | 231,507 | 200,472 | 179,760 | 127,695 | 87,434 | 74,955 | 64,650 | 48,463 | 36,841 |

| 2014 | Due north/A | 56,981,718 | 11,407,987 | 2,136,762 | 465,626 | 306,650 | 245,902 | 211,261 | 188,996 | 133,445 | 90,606 | 77,714 | 66,868 | 50,083 | 38,173 |

| 2015 | N/A | 59,380,503 | 11,930,649 | 2,220,264 | 480,930 | 316,913 | 253,979 | 218,911 | 195,778 | 138,031 | 93,212 | 79,655 | 68,632 | 51,571 | 39,275 |

| 2016 | Northward/A | 53,052,900 | ten,963,921 | 2,124,117 | 480,804 | 319,796 | 256,673 | 221,381 | 197,651 | 139,713 | 94,620 | lxxx,921 | 69,581 | 52,529 | 40,078 |

| 2017 | North/A | 63,430,119 | 12,899,070 | 2,374,937 | 515,371 | 339,478 | 271,182 | 232,955 | 208,053 | 145,135 | 97,870 | 83,682 | 72,268 | 54,672 | 41,740 |

| 2018 | N/A | 68,934,261 | 13,576,286 | 2,514,209 | 540,009 | 359,368 | 286,106 | 245,050 | 217,913 | 151,935 | 101,765 | 87,044 | 75,083 | 57,092 | 43,614 |

| 2019 | N/A | sixty,658,598 | 12,623,539 | two,458,432 | 546,434 | 364,693 | 291,384 | 249,320 | 221,572 | 154,589 | 103,012 | 87,917 | 75,991 | 57,685 | 44,269 |

| Adapted gross income flooring on percentiles (constant dollars): [ane] | |||||||||||||||

| 2001 | N/A | 23,122,756 | five,070,075 | one,028,574 | 226,299 | 153,204 | 123,829 | 107,503 | 97,477 | 70,960 | 50,050 | 43,562 | 38,275 | 29,737 | 23,187 |

| 2002 | N/A | 18,838,286 | four,281,406 | 905,052 | 215,257 | 145,824 | 119,483 | 105,069 | 95,022 | 69,549 | 49,366 | 42,926 | 37,588 | 29,123 | 22,746 |

| 2003 | N/A | 20,233,778 | 4,535,617 | 935,432 | 217,286 | 145,998 | 119,494 | 104,497 | 94,987 | 69,226 | 49,222 | 42,540 | 37,183 | 28,681 | 22,335 |

| 2004 | N/A | 26,837,716 | 5,851,285 | 1,119,666 | 235,289 | 155,239 | 125,347 | 108,419 | 97,410 | 70,476 | 49,875 | 43,456 | 37,900 | 29,122 | 22,576 |

| 2005 | N/A | 34,000,331 | 7,187,997 | 1,297,306 | 253,856 | 164,252 | 130,339 | 111,969 | 99,877 | 71,529 | 50,060 | 43,388 | 37,873 | 29,023 | 22,412 |

| 2006 | Northward/A | 35,450,947 | 7,554,773 | 1,377,837 | 261,091 | 167,834 | 133,486 | 114,433 | 102,069 | 72,643 | fifty,438 | 43,639 | 37,941 | 29,019 | 22,320 |

| 2007 | North/A | 39,694,751 | 8,037,443 | 1,419,305 | 268,877 | 170,517 | 135,455 | 116,313 | 103,962 | 73,390 | l,897 | 43,858 | 38,220 | 29,130 | 22,409 |

| 2008 | N/A | 30,083,049 | 6,131,043 | 1,133,972 | 238,320 | 158,094 | 127,353 | 110,276 | 99,279 | 70,925 | 49,111 | 42,388 | 36,755 | 28,002 | 21,457 |

| 2009 | N/A | 20,951,550 | 4,391,554 | 895,425 | 214,484 | 148,139 | 121,104 | 106,296 | 95,882 | 69,580 | 48,286 | 41,570 | 35,878 | 27,135 | 20,814 |

| 2010 | N/A | 27,002,020 | 5,253,368 | 979,848 | 221,637 | 151,550 | 123,466 | 107,328 | 96,870 | 69,918 | 48,239 | 41,442 | 35,679 | 26,915 | twenty,586 |

| 2011 | Northward/A | 24,384,229 | 5,130,754 | 998,068 | 225,976 | 152,779 | 124,021 | 107,967 | 97,460 | 69,806 | 47,787 | 40,960 | 35,322 | 26,567 | 20,234 |

| 2012 | N/A | 35,346,348 | 6,892,946 | i,230,737 | 247,541 | 162,818 | 129,797 | 111,854 | 100,124 | 71,296 | 48,656 | 41,773 | 36,003 | 27,036 | twenty,532 |

| 2013 | Northward/A | 25,301,633 | 5,307,815 | 1,044,025 | 240,528 | 161,031 | 129,886 | 112,474 | 100,854 | 71,643 | 49,055 | 42,053 | 36,272 | 27,190 | twenty,670 |

| 2014 | North/A | 31,464,229 | 6,299,275 | 1,179,880 | 257,110 | 169,326 | 135,782 | 116,654 | 104,360 | 73,686 | l,031 | 42,912 | 36,923 | 27,655 | 21,078 |

| 2015 | North/A | 32,752,622 | 6,580,612 | 1,224,635 | 265,268 | 174,800 | 140,088 | 120,745 | 107,986 | 76,134 | 51,413 | 43,935 | 37,855 | 28,445 | 21,663 |

| 2016 | Due north/A | 28,895,915 | 5,971,635 | 1,156,926 | 261,876 | 174,181 | 139,800 | 120,578 | 107,653 | 76,096 | 51,536 | 44,075 | 37,898 | 28,611 | 21,829 |

| 2017 | Due north/A | 33,829,397 | six,879,504 | ane,266,633 | 274,865 | 181,055 | 144,630 | 124,243 | 110,962 | 77,405 | 52,197 | 44,630 | 38,543 | 29,158 | 22,261 |

| 2018 | N/A | 35,884,571 | 7,067,301 | one,308,802 | 281,108 | 187,073 | 148,936 | 127,564 | 113,437 | 79,092 | 52,975 | 45,312 | 39,085 | 29,720 | 22,704 |

| 2019 | North/A | 31,011,553 | half dozen,453,752 | 1,256,867 | 279,363 | 186,448 | 148,969 | 127,464 | 113,278 | 79,033 | 52,665 | 44,947 | 38,850 | 29,491 | 22,632 |

| Adjusted gross income (millions of dollars): | |||||||||||||||

| 2001 | 6,116,274 | 84,705 | 216,684 | 492,437 | i,064,928 | 1,360,872 | i,582,562 | ane,768,355 | i,933,563 | 2,599,650 | 3,555,692 | three,933,186 | 4,263,535 | iv,810,102 | v,235,273 |

| 2002 | 5,982,260 | 68,565 | 179,420 | 420,987 | 960,352 | 1,247,308 | 1,463,587 | 1,647,849 | 1,812,094 | 2,472,326 | 3,431,568 | 3,811,534 | four,143,048 | 4,689,683 | 5,114,828 |

| 2003 | 6,156,994 | 83,238 | 206,010 | 465,594 | 1,030,178 | one,327,075 | 1,549,825 | 1,738,945 | 1,907,837 | 2,586,777 | 3,572,674 | 3,961,657 | 4,300,174 | 4,855,774 | five,286,949 |

| 2004 | half dozen,734,554 | 111,932 | 280,449 | 615,494 | one,278,879 | 1,610,803 | 1,855,778 | ii,061,398 | 2,243,098 | 2,968,169 | iv,010,897 | 4,423,150 | 4,782,507 | 5,371,578 | 5,826,206 |

| 2005 | vii,365,689 | 143,370 | 362,581 | 783,762 | 1,560,659 | 1,932,055 | 2,202,354 | two,426,492 | ii,623,077 | three,400,596 | 4,506,197 | 4,940,249 | 5,317,903 | 5,936,944 | six,412,897 |

| 2006 | vii,969,813 | 170,567 | 418,573 | 895,044 | one,761,119 | 2,166,188 | two,460,559 | two,704,549 | 2,918,422 | 3,759,733 | 4,947,104 | 5,412,038 | 5,815,385 | 6,474,937 | 6,980,130 |

| 2007 | viii,621,963 | 219,494 | 503,678 | 1,030,091 | 1,971,021 | 2,411,916 | two,729,468 | two,992,467 | 3,223,396 | 4,128,240 | 5,401,825 | v,898,437 | six,329,354 | 7,032,507 | 7,571,084 |

| 2008 | 8,206,158 | 173,257 | 397,957 | 825,898 | i,656,771 | two,072,196 | 2,380,698 | ii,639,100 | 2,867,730 | 3,772,889 | v,055,298 | 5,554,583 | five,986,923 | half dozen,690,342 | 7,228,036 |

| 2009 | seven,578,641 | 126,242 | 281,687 | 601,504 | 1,304,627 | 1,684,139 | 1,973,637 | ii,219,853 | 2,439,146 | 3,317,402 | 4,570,256 | 5,057,761 | 5,478,063 | 6,159,780 | 6,678,194 |

| 2010 | eight,039,779 | 166,727 | 366,563 | 742,989 | 1,517,146 | 1,922,058 | 2,228,360 | 2,486,918 | 2,716,199 | 3,631,364 | 4,927,262 | 5,430,952 | 5,864,278 | 6,564,169 | 7,095,680 |

| 2011 | 8,317,188 | 144,984 | 342,338 | 737,251 | 1,555,701 | ane,984,960 | 2,306,674 | ii,578,137 | ii,818,879 | 3,774,978 | five,120,188 | five,640,585 | six,088,552 | 6,810,489 | 7,356,627 |

| 2012 | 9,041,744 | 219,067 | 501,374 | ane,017,057 | 1,976,738 | two,446,464 | two,791,205 | iii,078,337 | three,330,944 | iv,327,899 | five,722,980 | 6,261,677 | six,725,553 | 7,473,507 | viii,037,800 |

| 2013 | 9,033,840 | 168,992 | 384,881 | 815,662 | i,719,794 | ii,195,723 | 2,550,046 | 2,847,179 | 3,109,388 | four,143,498 | 5,591,750 | 6,151,678 | half dozen,633,611 | 7,409,491 | 7,995,603 |

| 2014 | nine,708,663 | 207,145 | 475,714 | 986,078 | 1,997,819 | two,514,973 | 2,895,712 | iii,212,471 | 3,490,867 | iv,583,416 | vi,104,146 | vi,690,287 | 7,193,799 | 8,002,581 | 8,614,544 |

| 2015 | 10,142,620 | 214,647 | 495,201 | 1,033,473 | 2,094,906 | 2,636,987 | iii,034,889 | 3,366,920 | 3,658,556 | four,803,327 | 6,389,094 | vi,997,737 | 7,519,683 | 8,360,826 | 8,998,075 |

| 2016 | x,156,612 | 204,934 | 460,894 | 966,465 | 2,003,066 | ii,544,904 | 2,946,100 | iii,280,595 | 3,574,828 | 4,729,405 | 6,333,469 | 6,950,051 | 7,479,129 | 8,331,664 | 8,979,705 |

| 2017 | x,936,500 | 256,250 | 565,453 | 1,150,471 | 2,301,449 | two,889,391 | 3,321,003 | 3,680,328 | three,995,037 | 5,220,949 | half dozen,913,130 | 7,561,368 | viii,118,508 | nine,019,611 | 9,706,054 |

| 2018 | 11,563,883 | 241,954 | 570,189 | one,196,670 | ii,420,025 | 3,044,552 | 3,503,876 | 3,884,856 | 4,217,996 | 5,511,117 | 7,289,834 | seven,969,121 | eight,552,653 | nine,499,838 | 10,221,814 |

| 2019 | 11,882,850 | 214,487 | 522,449 | i,140,517 | ii,393,383 | iii,042,810 | 3,523,664 | 3,921,774 | 4,269,727 | 5,621,027 | 7,472,188 | 8,177,266 | viii,783,586 | 9,766,007 | 10,517,131 |

| Total income tax (millions of dollars): [two] | |||||||||||||||

| 2001 | 884,931 | 20,363 | 57,329 | 138,735 | 293,968 | 358,761 | 401,189 | 434,411 | 462,288 | 563,525 | 681,732 | 721,756 | 755,307 | 807,098 | 841,587 |

| 2002 | 794,282 | xvi,728 | 48,388 | 119,894 | 262,820 | 323,052 | 362,355 | 393,407 | 419,871 | 513,320 | 620,746 | 656,602 | 687,111 | 731,873 | 760,808 |

| 2003 | 745,514 | 17,169 | 47,192 | 114,559 | 251,146 | 308,878 | 345,930 | 374,786 | 399,176 | 483,792 | 582,130 | 617,015 | 645,885 | 688,113 | 715,163 |

| 2004 | 829,096 | 21,437 | 59,739 | 141,937 | 300,802 | 367,392 | 409,259 | 440,979 | 467,165 | 558,007 | 659,803 | 694,983 | 724,830 | 769,074 | 797,040 |

| 2005 | 931,693 | 27,171 | 75,151 | 176,152 | 361,264 | 437,452 | 485,042 | 520,483 | 549,068 | 647,115 | 755,252 | 792,545 | 823,488 | 869,272 | 898,262 |

| 2006 | 1,020,438 | xxx,860 | 83,499 | 196,358 | 401,610 | 485,109 | 536,823 | 575,603 | 607,088 | 715,108 | 832,153 | 872,385 | 905,569 | 954,823 | 985,657 |

| 2007 | ane,111,872 | 38,587 | 97,979 | 220,636 | 442,633 | 534,150 | 590,292 | 631,830 | 666,021 | 782,903 | 909,392 | 952,964 | 988,633 | i,041,166 | ane,074,502 |

| 2008 | 1,028,669 | 33,136 | 83,085 | 187,200 | 385,857 | 470,285 | 523,500 | 563,684 | 597,246 | 711,873 | 837,561 | 880,244 | 915,035 | 965,691 | 996,815 |

| 2009 | 863,486 | 26,328 | 64,253 | 146,030 | 313,826 | 387,828 | 435,662 | 472,299 | 502,274 | 603,504 | 712,700 | 749,022 | 777,801 | 818,789 | 842,286 |

| 2010 | 949,144 | 31,453 | 76,390 | 169,734 | 354,810 | 436,043 | 488,303 | 528,045 | 560,649 | 670,319 | 787,407 | 826,796 | 858,000 | 901,560 | 926,782 |

| 2011 | 1,042,571 | 26,488 | 70,545 | 168,222 | 365,518 | 453,679 | 510,000 | 553,220 | 588,967 | 711,663 | 846,579 | 892,616 | 929,529 | 981,800 | 1,012,460 |

| 2012 | 1,184,978 | 38,563 | 97,902 | 220,414 | 451,328 | 550,934 | 613,192 | 660,121 | 698,543 | 831,445 | 975,377 | 1,024,046 | ane,063,388 | one,119,368 | 1,152,063 |

| 2013 | 1,231,911 | xl,764 | 100,868 | 227,623 | 465,705 | 567,786 | 631,900 | 680,817 | 721,242 | 859,863 | one,011,220 | 1,062,798 | 1,104,510 | 1,163,238 | 1,197,603 |

| 2014 | 1,374,379 | 49,740 | 123,288 | 272,826 | 542,640 | 656,229 | 727,556 | 780,687 | 824,153 | 974,124 | one,137,716 | 1,192,679 | ane,236,678 | 1,299,383 | 1,336,637 |

| 2015 | i,454,325 | 51,375 | 127,236 | 283,577 | 567,697 | 688,137 | 763,764 | 820,335 | 866,447 | 1,026,601 | 1,201,501 | ane,259,698 | one,306,271 | 1,373,073 | 1,413,200 |

| 2016 | ane,442,385 | 46,845 | 115,384 | 261,423 | 538,257 | 658,950 | 735,763 | 793,331 | 839,898 | 1,002,072 | 1,180,713 | 1,240,010 | 1,288,231 | 1,356,952 | 1,398,523 |

| 2017 | 1,601,309 | 61,750 | 143,024 | 309,765 | 615,979 | 748,944 | 833,142 | 895,962 | 946,954 | ane,122,158 | 1,314,957 | 1,378,757 | 1,430,369 | i,505,513 | i,551,537 |

| 2018 | i,536,178 | 55,455 | 139,455 | 310,631 | 615,716 | 737,900 | 815,821 | 876,470 | 926,367 | 1,096,343 | one,279,036 | ane,336,041 | i,382,868 | 1,450,202 | 1,491,041 |

| 2019 | 1,578,661 | 49,185 | 128,817 | 297,920 | 612,027 | 739,896 | 822,470 | 886,070 | 938,429 | 1,117,856 | i,308,416 | 1,367,843 | ane,416,809 | 1,487,163 | 1,530,288 |

| Average tax rate (per centum): [three] | |||||||||||||||

| 2001 | 14.47 | 24.04 | 26.46 | 28.17 | 27.60 | 26.36 | 25.35 | 24.57 | 23.91 | 21.68 | nineteen.17 | 18.35 | 17.72 | 16.78 | 16.08 |

| 2002 | thirteen.28 | 24.twoscore | 26.97 | 28.48 | 27.37 | 25.90 | 24.76 | 23.87 | 23.17 | 20.76 | xviii.09 | 17.23 | sixteen.58 | 15.61 | 14.87 |

| 2003 | 12.11 | 20.63 | 22.91 | 24.threescore | 24.38 | 23.28 | 22.32 | 21.55 | twenty.92 | xviii.70 | 16.29 | 15.57 | fifteen.02 | 14.17 | xiii.53 |

| 2004 | 12.31 | nineteen.15 | 21.30 | 23.06 | 23.52 | 22.81 | 22.05 | 21.39 | 20.83 | xviii.80 | sixteen.45 | 15.71 | 15.16 | 14.32 | 13.68 |

| 2005 | 12.65 | eighteen.95 | 20.73 | 22.48 | 23.15 | 22.64 | 22.02 | 21.45 | twenty.93 | 19.03 | 16.76 | 16.04 | 15.49 | 14.64 | 14.01 |

| 2006 | 12.80 | 18.09 | 19.95 | 21.94 | 22.fourscore | 22.39 | 21.82 | 21.28 | 20.80 | 19.02 | 16.82 | xvi.12 | xv.57 | 14.75 | xiv.12 |

| 2007 | 12.ninety | 17.58 | 19.45 | 21.42 | 22.46 | 22.15 | 21.63 | 21.xi | 20.66 | 18.96 | 16.83 | xvi.16 | 15.62 | fourteen.81 | 14.19 |

| 2008 | 12.54 | 19.13 | xx.88 | 22.67 | 23.29 | 22.lxx | 21.99 | 21.36 | twenty.83 | 18.87 | 16.57 | xv.85 | xv.28 | 14.43 | 13.79 |

| 2009 | 11.39 | 20.86 | 22.81 | 24.28 | 24.05 | 23.03 | 22.07 | 21.28 | 20.59 | 18.19 | 15.59 | 14.81 | 14.20 | 13.29 | 12.61 |

| 2010 | 11.81 | 18.87 | twenty.84 | 22.84 | 23.39 | 22.69 | 21.91 | 21.23 | 20.64 | 18.46 | 15.98 | 15.22 | 14.63 | 13.73 | 13.06 |

| 2011 | 12.54 | 18.27 | xx.61 | 22.82 | 23.50 | 22.86 | 22.eleven | 21.46 | 20.89 | 18.85 | sixteen.53 | 15.82 | 15.27 | 14.42 | thirteen.76 |

| 2012 | thirteen.11 | 17.60 | 19.53 | 21.67 | 22.83 | 22.52 | 21.97 | 21.44 | xx.97 | xix.21 | 17.04 | 16.35 | 15.81 | 14.98 | 14.33 |

| 2013 | 13.64 | 24.12 | 26.21 | 27.91 | 27.08 | 25.86 | 24.78 | 23.91 | 23.20 | 20.75 | 18.08 | 17.28 | 16.65 | 15.70 | xiv.98 |

| 2014 | 14.16 | 24.01 | 25.92 | 27.67 | 27.16 | 26.09 | 25.13 | 24.30 | 23.61 | 21.25 | xviii.64 | 17.83 | 17.nineteen | 16.24 | 15.52 |

| 2015 | xiv.34 | 23.93 | 25.69 | 27.44 | 27.10 | 26.10 | 25.17 | 24.36 | 23.68 | 21.37 | eighteen.81 | 18.00 | 17.37 | 16.42 | xv.71 |

| 2016 | xiv.20 | 22.86 | 25.03 | 27.05 | 26.87 | 25.89 | 24.97 | 24.18 | 23.49 | 21.nineteen | 18.64 | 17.84 | 17.22 | xvi.29 | 15.57 |

| 2017 | 14.64 | 24.ten | 25.29 | 26.93 | 26.76 | 25.92 | 25.09 | 24.34 | 23.seventy | 21.49 | 19.02 | 18.23 | 17.62 | sixteen.69 | xv.99 |

| 2018 | xiii.28 | 22.92 | 24.46 | 25.96 | 25.44 | 24.24 | 23.28 | 22.56 | 21.96 | 19.89 | 17.55 | sixteen.77 | 16.17 | xv.27 | 14.59 |

| 2019 | 13.29 | 22.93 | 24.66 | 26.12 | 25.57 | 24.32 | 23.34 | 22.59 | 21.98 | nineteen.89 | 17.51 | 16.73 | 16.13 | fifteen.23 | fourteen.55 |

| Adjusted gross income share (percentage): | |||||||||||||||

| 2001 | 100.00 | 1.38 | iii.54 | 8.05 | 17.41 | 22.25 | 25.87 | 28.91 | 31.61 | 42.l | 58.13 | 64.31 | 69.71 | 78.64 | 85.60 |

| 2002 | 100.00 | 1.xv | iii.00 | 7.04 | sixteen.05 | xx.85 | 24.47 | 27.55 | 30.29 | 41.33 | 57.36 | 63.71 | 69.26 | 78.39 | 85.50 |

| 2003 | 100.00 | 1.35 | three.35 | 7.56 | 16.73 | 21.55 | 25.17 | 28.24 | xxx.99 | 42.01 | 58.03 | 64.34 | 69.84 | 78.87 | 85.87 |

| 2004 | 100.00 | 1.66 | 4.16 | 9.14 | 18.99 | 23.92 | 27.56 | 30.61 | 33.31 | 44.07 | 59.56 | 65.68 | 71.01 | 79.76 | 86.51 |

| 2005 | 100.00 | i.95 | 4.92 | ten.64 | 21.xix | 26.23 | 29.90 | 32.94 | 35.61 | 46.17 | 61.eighteen | 67.07 | 72.20 | fourscore.60 | 87.06 |

| 2006 | 100.00 | 2.fourteen | 5.25 | 11.23 | 22.10 | 27.eighteen | 30.87 | 33.93 | 36.62 | 47.17 | 62.07 | 67.91 | 72.97 | 81.24 | 87.58 |

| 2007 | 100.00 | 2.55 | 5.84 | 11.95 | 22.86 | 27.97 | 31.66 | 34.71 | 37.39 | 47.88 | 62.65 | 68.41 | 73.41 | 81.57 | 87.81 |

| 2008 | 100.00 | 2.eleven | 4.85 | ten.06 | 20.19 | 25.25 | 29.01 | 32.16 | 34.95 | 45.98 | 61.60 | 67.69 | 72.96 | 81.53 | 88.08 |

| 2009 | 100.00 | 1.67 | 3.72 | seven.94 | 17.21 | 22.22 | 26.04 | 29.29 | 32.18 | 43.77 | 60.thirty | 66.74 | 72.28 | 81.28 | 88.12 |

| 2010 | 100.00 | 2.07 | 4.56 | 9.24 | xviii.87 | 23.91 | 27.72 | 30.93 | 33.78 | 45.17 | 61.29 | 67.55 | 72.94 | 81.65 | 88.26 |

| 2011 | 100.00 | one.74 | 4.12 | 8.86 | 18.70 | 23.87 | 27.73 | 31.00 | 33.89 | 45.39 | 61.56 | 67.82 | 73.xx | 81.88 | 88.45 |

| 2012 | 100.00 | 2.42 | v.55 | 11.25 | 21.86 | 27.06 | 30.87 | 34.05 | 36.84 | 47.87 | 63.thirty | 69.25 | 74.38 | 82.66 | 88.ninety |

| 2013 | 100.00 | 1.87 | 4.26 | 9.03 | 19.04 | 24.31 | 28.23 | 31.52 | 34.42 | 45.87 | 61.90 | 68.10 | 73.43 | 82.02 | 88.51 |

| 2014 | 100.00 | ii.13 | 4.90 | 10.16 | 20.58 | 25.90 | 29.83 | 33.09 | 35.96 | 47.21 | 62.87 | 68.91 | 74.ten | 82.43 | 88.73 |

| 2015 | 100.00 | 2.12 | 4.88 | 10.19 | 20.65 | 26.00 | 29.92 | 33.20 | 36.07 | 47.36 | 62.99 | 68.99 | 74.14 | 82.43 | 88.72 |

| 2016 | 100.00 | 2.02 | 4.54 | nine.52 | 19.72 | 25.06 | 29.01 | 32.30 | 35.20 | 46.56 | 62.36 | 68.43 | 73.64 | 82.03 | 88.41 |

| 2017 | 100.00 | 2.34 | 5.17 | 10.52 | 21.04 | 26.42 | xxx.37 | 33.65 | 36.53 | 47.74 | 63.21 | 69.14 | 74.23 | 82.47 | 88.75 |

| 2018 | 100.00 | ii.09 | 4.93 | x.35 | 20.93 | 26.33 | 30.xxx | 33.59 | 36.48 | 47.66 | 63.04 | 68.91 | 73.96 | 82.15 | 88.39 |

| 2019 | 100.00 | 1.81 | 4.40 | 9.60 | 20.fourteen | 25.61 | 29.65 | 33.00 | 35.93 | 47.30 | 62.88 | 68.82 | 73.92 | 82.19 | 88.51 |

| Total income revenue enhancement share (pct): | |||||||||||||||

| 2001 | 100.00 | 2.thirty | six.48 | 15.68 | 33.22 | 40.54 | 45.34 | 49.09 | 52.24 | 63.68 | 77.04 | 81.56 | 85.35 | 91.xx | 95.10 |

| 2002 | 100.00 | 2.11 | vi.09 | 15.09 | 33.09 | 40.67 | 45.62 | 49.53 | 52.86 | 64.63 | 78.xv | 82.67 | 86.51 | 92.14 | 95.79 |

| 2003 | 100.00 | two.30 | 6.33 | 15.37 | 33.69 | 41.43 | 46.40 | l.27 | 53.54 | 64.89 | 78.08 | 82.76 | 86.64 | 92.thirty | 95.93 |

| 2004 | 100.00 | 2.59 | vii.21 | 17.12 | 36.28 | 44.31 | 49.36 | 53.19 | 56.35 | 67.30 | 79.58 | 83.82 | 87.42 | 92.76 | 96.thirteen |

| 2005 | 100.00 | 2.92 | 8.07 | xviii.91 | 38.78 | 46.95 | 52.06 | 55.86 | 58.93 | 69.46 | 81.06 | 85.07 | 88.39 | 93.30 | 96.41 |

| 2006 | 100.00 | iii.02 | 8.eighteen | 19.24 | 39.36 | 47.54 | 52.61 | 56.41 | 59.49 | 70.08 | 81.55 | 85.49 | 88.74 | 93.57 | 96.59 |

| 2007 | 100.00 | 3.47 | eight.81 | xix.84 | 39.81 | 48.04 | 53.09 | 56.83 | 59.ninety | lxx.41 | 81.79 | 85.71 | 88.92 | 93.64 | 96.64 |

| 2008 | 100.00 | iii.22 | viii.08 | 18.20 | 37.51 | 45.72 | l.89 | 54.80 | 58.06 | 69.20 | 81.42 | 85.57 | 88.95 | 93.88 | 96.90 |

| 2009 | 100.00 | 3.05 | seven.44 | 16.91 | 36.34 | 44.91 | 50.45 | 54.lxx | 58.17 | 69.89 | 82.54 | 86.74 | 90.08 | 94.82 | 97.54 |

| 2010 | 100.00 | 3.31 | eight.05 | 17.88 | 37.38 | 45.94 | 51.45 | 55.63 | 59.07 | 70.62 | 82.96 | 87.eleven | xc.40 | 94.99 | 97.64 |

| 2011 | 100.00 | 2.54 | 6.77 | xvi.xiv | 35.06 | 43.52 | 48.92 | 53.06 | 56.49 | 68.26 | 81.20 | 85.62 | 89.sixteen | 94.17 | 97.xi |

| 2012 | 100.00 | 3.25 | 8.26 | xviii.lx | 38.09 | 46.49 | 51.75 | 55.71 | 58.95 | 70.17 | 82.31 | 86.42 | 89.74 | 94.46 | 97.22 |

| 2013 | 100.00 | 3.31 | viii.19 | 18.48 | 37.80 | 46.09 | 51.29 | 55.27 | 58.55 | 69.lxxx | 82.09 | 86.27 | 89.66 | 94.43 | 97.22 |

| 2014 | 100.00 | 3.62 | 8.97 | xix.85 | 39.48 | 47.75 | 52.94 | 56.fourscore | 59.97 | 70.88 | 82.78 | 86.78 | 89.98 | 94.54 | 97.25 |

| 2015 | 100.00 | three.53 | 8.75 | 19.50 | 39.04 | 47.32 | 52.52 | 56.41 | 59.58 | 70.59 | 82.62 | 86.62 | 89.82 | 94.41 | 97.17 |

| 2016 | 100.00 | 3.25 | viii.00 | 18.12 | 37.32 | 45.68 | 51.01 | 55.00 | 58.23 | 69.47 | 81.86 | 85.97 | 89.31 | 94.08 | 96.96 |

| 2017 | 100.00 | 3.86 | 8.93 | 19.34 | 38.47 | 46.77 | 52.03 | 55.95 | 59.xiv | seventy.08 | 82.12 | 86.10 | 89.33 | 94.02 | 96.89 |

| 2018 | 100.00 | three.61 | 9.08 | 20.22 | 40.08 | 48.03 | 53.11 | 57.06 | threescore.30 | 71.37 | 83.26 | 86.97 | ninety.02 | 94.40 | 97.06 |

| 2019 | 100.00 | iii.12 | 8.16 | 18.87 | 38.77 | 46.87 | 52.x | 56.xiii | 59.44 | 70.81 | 82.88 | 86.65 | 89.75 | 94.20 | 96.94 |

| Notes: N/A– Not applicable. [one] For Table 4.ane, constant dollars were calculated using the U.S. Bureau of Labor Statistics' consumer price index for urban consumers (CPI-U, 1990=100). For 2019 the CPI-U = 255.657. [2] Total income taxation was the sum of income taxation later credits (including the subtraction of excess accelerate premium taxation credit repayment, the earned income credit, American opportunity credit, wellness coverage revenue enhancement credit, and the regulated investment credit credit) limited to zero plus cyberspace investment income tax from Course 8960 and the tax fromForm 4970, Tax on Accumulation Distribution of Trusts. It does not include any refundable portions of these credits. [3] The boilerplate tax rate was computed by dividing total income tax (see footnote 2) past adjusted gross income. [4] The total number of returns does non include the returns filed by individuals to merely receive the economic stimulus payment and who had no other reason to file. Source: IRS, Statistics of Income Division, Publication 1304, November 2021 | |||||||||||||||

| [All figures are estimates based on samples] | ||||||

|---|---|---|---|---|---|---|

| Item, taxation twelvemonth | Total | Ascending cumulative percentiles | ||||

| Bottom 50 percent | Bottom 75 percent | Lesser 90 percent | Lesser 95 percentage | Lesser 99 Percent | ||

| Number of returns: | ||||||

| 2001 | 119,370,886 | 59,685,443 | 89,528,165 | 107,433,797 | 113,402,342 | 118,177,177 |

| 2002 | 119,850,561 | 59,925,281 | 89,887,921 | 107,865,505 | 113,858,033 | 118,652,055 |

| 2003 | 120,758,947 | 60,379,474 | xc,569,210 | 108,683,052 | 114,721,000 | 119,551,358 |

| 2004 | 122,509,974 | 61,254,987 | 91,882,481 | 110,258,977 | 116,384,475 | 121,284,874 |

| 2005 | 124,673,055 | 62,336,528 | 93,504,791 | 112,205,750 | 118,439,402 | 123,426,324 |

| 2006 | 128,441,165 | 64,220,583 | 96,330,874 | 115,597,049 | 122,019,107 | 127,156,753 |

| 2007 | [3] 132,654,911 | 66,327,456 | 99,491,183 | 119,389,420 | 126,022,165 | 131,328,362 |

| 2008 | 132,891,770 | 66,445,885 | 99,668,828 | 119,602,593 | 126,247,182 | 131,562,852 |

| 2009 | 132,619,936 | 66,309,968 | 99,464,952 | 119,357,942 | 125,988,939 | 131,293,737 |

| 2010 | 135,033,492 | 67,516,746 | 101,275,119 | 121,530,143 | 128,281,817 | 133,683,157 |

| 2011 | 136,585,712 | 68,292,856 | 102,439,284 | 122,927,141 | 129,756,426 | 135,219,855 |

| 2012 | 136,080,353 | 68,040,177 | 102,060,265 | 122,472,318 | 129,276,335 | 134,719,549 |

| 2013 | 138,313,155 | 69,156,578 | 103,734,866 | 124,481,840 | 131,397,497 | 136,930,023 |

| 2014 | 139,562,034 | 69,781,017 | 104,671,526 | 125,605,831 | 132,583,932 | 138,166,414 |

| 2015 | 141,204,625 | 70,602,313 | 105,903,469 | 127,084,163 | 134,144,394 | 139,792,579 |

| 2016 | 140,888,785 | 70,444,393 | 105,666,589 | 126,799,907 | 133,844,346 | 139,479,897 |

| 2017 | 143,295,160 | 71,647,580 | 107,471,370 | 128,965,644 | 136,130,402 | 141,862,208 |

| 2018 | 144,317,866 | 72,158,933 | 108,238,400 | 129,886,079 | 137,101,973 | 142,874,687 |

| 2019 | 148,245,929 | 74,122,965 | 111,184,447 | 133,421,336 | 140,833,633 | 146,763,470 |

| Adjusted gross income (millions of dollars): | iii,928,063 | two.7% | ||||

| 2001 | half dozen,116,274 | 881,001 | 2,183,088 | 3,516,624 | 4,182,711 | five,051,346 |

| 2002 | five,982,260 | 867,431 | 2,170,726 | 3,509,933 | four,170,166 | 5,021,907 |

| 2003 | six,156,994 | 870,045 | two,195,336 | three,570,217 | four,249,157 | 5,126,816 |

| 2004 | vi,734,554 | 908,348 | ii,311,404 | 3,766,385 | 4,491,456 | 5,455,674 |

| 2005 | 7,365,689 | 952,792 | two,425,440 | 3,965,094 | 4,742,612 | 5,805,030 |

| 2006 | seven,969,813 | 989,682 | 2,557,775 | 4,210,079 | 5,051,390 | 6,208,693 |

| 2007 | viii,621,963 | one,050,879 | 2,723,525 | 4,493,722 | 5,398,566 | 6,650,942 |

| 2008 | eight,206,158 | 978,122 | 2,651,575 | 4,433,269 | 5,338,428 | six,549,387 |

| 2009 | 7,578,641 | 900,447 | ii,520,880 | four,261,239 | five,139,495 | half dozen,274,014 |

| 2010 | 8,039,779 | 944,099 | 2,608,826 | 4,408,415 | 5,323,580 | 6,522,633 |

| 2011 | 8,317,188 | 960,561 | 2,676,602 | 4,542,210 | v,498,309 | 6,761,487 |

| 2012 | nine,041,744 | 1,003,944 | 2,780,067 | 4,713,845 | 5,710,800 | 7,065,006 |

| 2013 | 9,033,840 | 1,038,237 | two,882,162 | 4,890,343 | five,924,452 | 7,314,046 |

| 2014 | 9,708,663 | i,094,119 | iii,018,376 | five,125,247 | half-dozen,217,796 | 7,710,844 |

| 2015 | 10,142,620 | ane,144,545 | three,144,883 | 5,339,293 | 6,484,064 | 8,047,714 |

| 2016 | x,156,612 | 1,176,907 | iii,206,562 | v,427,208 | 6,581,784 | eight,153,546 |

| 2017 | ten,936,500 | 1,230,446 | 3,375,132 | 5,715,551 | 6,941,463 | 8,635,051 |

| 2018 | 11,563,883 | 1,342,069 | three,594,762 | half dozen,052,766 | 7,345,887 | ix,143,858 |

| 2019 | 11,882,850 | 1,365,719 | 3,705,584 | vi,261,823 | 7,613,122 | ix,489,467 |

| Total income tax (millions of dollars): [i] | 318,967 | 2.eight% | ||||

| 2001 | 884,931 | 43,344 | 163,175 | 321,406 | 422,643 | 590,963 |

| 2002 | 794,282 | 33,474 | 137,679 | 280,962 | 374,411 | 531,462 |

| 2003 | 745,514 | thirty,351 | 128,499 | 261,722 | 346,338 | 494,368 |

| 2004 | 829,096 | 32,054 | 134,114 | 271,089 | 361,932 | 528,294 |

| 2005 | 931,693 | 33,431 | 139,143 | 284,578 | 382,625 | 570,430 |

| 2006 | 1,020,438 | 34,781 | 148,053 | 305,330 | 413,350 | 618,828 |

| 2007 | 1,111,872 | 37,371 | 158,909 | 328,969 | 445,851 | 669,239 |

| 2008 | i,028,669 | 31,857 | 148,425 | 316,797 | 431,423 | 642,812 |

| 2009 | 863,486 | 21,200 | 114,465 | 259,982 | 361,213 | 549,660 |

| 2010 | 949,144 | 22,363 | 122,347 | 278,824 | 388,495 | 594,333 |

| 2011 | i,042,571 | 30,109 | 149,953 | 330,907 | 453,605 | 677,052 |

| 2012 | 1,184,978 | 32,915 | 160,934 | 353,533 | 486,435 | 733,650 |

| 2013 | 1,231,911 | 34,307 | 169,113 | 372,048 | 510,669 | 766,206 |

| 2014 | 1,374,379 | 37,740 | 181,700 | 400,255 | 550,226 | 831,738 |

| 2015 | 1,454,325 | 41,125 | 194,628 | 427,723 | 587,879 | 886,628 |

| 2016 | one,442,385 | 43,863 | 202,378 | 440,313 | 602,487 | 904,128 |

| 2017 | 1,601,309 | 49,772 | 222,552 | 479,151 | 654,355 | 985,330 |

| 2018 | one,536,178 | 45,137 | 200,137 | 439,835 | 609,811 | 920,462 |

| 2019 | 1,578,661 | 48,373 | 210,818 | 460,789 | 640,232 | 966,634 |

| Average tax rate (percentage): [2] | ||||||

| 2001 | fourteen.47 | iv.92 | 7.47 | 9.14 | 10.10 | eleven.70 |

| 2002 | 13.28 | 3.86 | half dozen.34 | 8.00 | 8.98 | ten.58 |

| 2003 | 12.11 | 3.49 | 5.85 | 7.33 | 8.15 | ix.64 |

| 2004 | 12.31 | 3.53 | 5.fourscore | vii.20 | 8.06 | 9.68 |

| 2005 | 12.65 | 3.51 | v.74 | vii.eighteen | eight.07 | 9.83 |

| 2006 | 12.80 | 3.51 | v.79 | seven.25 | 8.18 | 9.97 |

| 2007 | 12.90 | iii.56 | five.83 | 7.32 | 8.26 | 10.06 |

| 2008 | 12.54 | 3.26 | 5.lx | 7.15 | eight.08 | 9.81 |

| 2009 | 11.39 | 2.35 | 4.54 | 6.10 | 7.03 | 8.76 |

| 2010 | xi.81 | 2.37 | iv.69 | 6.32 | 7.30 | 9.eleven |

| 2011 | 12.54 | iii.xiii | 5.sixty | 7.29 | 8.25 | 10.01 |

| 2012 | 13.11 | 3.28 | 5.79 | 7.50 | 8.52 | x.38 |

| 2013 | 13.64 | three.30 | 5.87 | vii.61 | eight.62 | 10.48 |

| 2014 | fourteen.sixteen | three.45 | 6.02 | 7.81 | 8.85 | 10.79 |

| 2015 | 14.34 | three.59 | 6.19 | 8.01 | 9.07 | eleven.02 |

| 2016 | 14.20 | iii.73 | 6.31 | 8.xi | ix.15 | xi.09 |

| 2017 | 14.64 | 4.05 | 6.59 | 8.38 | 9.43 | eleven.41 |

| 2018 | 13.28 | three.36 | 5.57 | seven.27 | 8.thirty | 10.07 |

| 2019 | 13.29 | three.54 | 5.69 | 7.36 | 8.41 | 10.xix |

| Adjusted gross income share (per centum): | ||||||

| 2001 | 100.00 | 14.40 | 35.69 | 57.50 | 68.39 | 82.59 |

| 2002 | 100.00 | 14.50 | 36.29 | 58.67 | 69.71 | 83.95 |

| 2003 | 100.00 | 14.13 | 35.66 | 57.99 | 69.01 | 83.27 |

| 2004 | 100.00 | 13.49 | 34.32 | 55.93 | 66.69 | 81.01 |

| 2005 | 100.00 | 12.94 | 32.93 | 53.83 | 64.39 | 78.81 |

| 2006 | 100.00 | 12.42 | 32.09 | 52.83 | 63.38 | 77.90 |

| 2007 | 100.00 | 12.19 | 31.59 | 52.12 | 62.61 | 77.xiv |

| 2008 | 100.00 | 11.92 | 32.31 | 54.02 | 65.05 | 79.81 |

| 2009 | 100.00 | xi.88 | 33.26 | 56.23 | 67.82 | 82.79 |

| 2010 | 100.00 | 11.74 | 32.45 | 54.83 | 66.22 | 81.thirteen |

| 2011 | 100.00 | xi.55 | 32.18 | 54.61 | 66.11 | 81.30 |

| 2012 | 100.00 | xi.10 | 30.75 | 52.13 | 63.16 | 78.fourteen |

| 2013 | 100.00 | 11.49 | 31.xc | 54.13 | 65.58 | lxxx.96 |

| 2014 | 100.00 | eleven.27 | 31.09 | 52.79 | 64.04 | 79.42 |

| 2015 | 100.00 | 11.28 | 31.01 | 52.64 | 63.93 | 79.35 |

| 2016 | 100.00 | 11.59 | 31.57 | 53.44 | 64.fourscore | eighty.28 |

| 2017 | 100.00 | 11.25 | 30.86 | 52.26 | 63.47 | 78.96 |

| 2018 | 100.00 | 11.61 | 31.09 | 52.34 | 63.52 | 79.07 |

| 2019 | 100.00 | xi.49 | 31.18 | 52.70 | 64.07 | 79.86 |

| Total income revenue enhancement share (per centum): | ||||||

| 2001 | 100.00 | 4.90 | 18.44 | 36.32 | 47.76 | 66.78 |

| 2002 | 100.00 | 4.21 | 17.33 | 35.37 | 47.14 | 66.91 |

| 2003 | 100.00 | four.07 | 17.24 | 35.eleven | 46.46 | 66.31 |

| 2004 | 100.00 | three.87 | 16.18 | 32.seventy | 43.65 | 63.72 |

| 2005 | 100.00 | three.59 | 14.93 | 30.54 | 41.07 | 61.23 |

| 2006 | 100.00 | 3.41 | xiv.51 | 29.92 | 40.51 | 60.64 |

| 2007 | 100.00 | iii.36 | 14.29 | 29.59 | twoscore.x | 60.19 |

| 2008 | 100.00 | 3.10 | 14.43 | 30.fourscore | 41.94 | 62.49 |

| 2009 | 100.00 | 2.46 | 13.26 | xxx.11 | 41.83 | 63.66 |

| 2010 | 100.00 | two.36 | 12.89 | 29.38 | 40.93 | 62.62 |

| 2011 | 100.00 | 2.89 | fourteen.38 | 31.74 | 43.51 | 64.94 |

| 2012 | 100.00 | ii.78 | 13.58 | 29.83 | 41.05 | 61.91 |

| 2013 | 100.00 | 2.78 | 13.73 | thirty.20 | 41.45 | 62.20 |

| 2014 | 100.00 | 2.75 | 13.22 | 29.12 | 40.03 | lx.52 |

| 2015 | 100.00 | two.83 | 13.38 | 29.41 | 40.42 | lx.96 |